Book an appointment

Choose from in-person or phone appointments at a time and location that’s convenient for you.

If you’re an existing online and mobile banking customer, we’ll send you an email to let you know when you’ll be able to download and use the new app. New online and mobile banking customers can download the app now.

Get ready for your new mobile and online banking experience, with features that make it easier, faster and more convenient to manage your money, your way.

Recover your username or reset your password here. Once you have your username and password, you'll be able to log in through BOH.com or the new Bank of Hawaii mobile app.

Yes! We’re excited to launch a new mobile app along with the new online banking experience. You’ll be able to download the new app as part of your upgrade.

To ensure the mobile app works as expected, we recommend making sure your phone is up-to-date with any software updates before downloading the new mobile app.

In the new mobile and online experience, you’ll have access to personalized financial insights, budgeting and finance management tools, personalization options, and have a streamlined experience between mobile and online! But don’t worry—your account preferences, automatic payments, and scheduled transfers/transactions will not be impacted.

Your contact phone number might be out of date. Please reach out to our Customer Service Center or visit a nearby branch and our team will be happy to assist.

Yes, but you may need to reconnect your Bank of Hawaii account to the third-party financial platform (i.e. Robinhood®, Rocket Money®, Quicken® and QuickBooks®).

No. The way you access and manage Bankoh Business Connection accounts will not change with this upgrade.

Yes, but you may need to reconnect your Bank of Hawaii account to the third-party financial platform (i.e. Robinhood®, Rocket Money®, Quicken® and QuickBooks®).

Learn how to link your Bank of Hawaii account in this quick reference guide. Download guide

You can connect your Bank of Hawaii account using two methods: logging in using your username and password (Express Web Connect) or downloading transactions directly from your Bank of Hawaii online banking account and then uploading the file to Quicken (Web Connect). Learn how to link your Bank of Hawaii account in this quick reference guide. Download Quicken Classic Guide

Requests to change your address, phone, or email address can be made via online banking, in person at a branch, by mail, or by phone. To learn more about updating your contact information, click here.

For Bankohana II and III account holders, cashier's checks are free of charge. For all others, cashier's checks are $12. We do not offer personal money orders at this time.

Easily move money from one account to another.

Contact your local branch for information on safe deposit boxes.

Notary Services from Bank of Hawaii are available by appointment only.

For information on how to set up direct deposit and other options, visit our direct deposit page.

A wire transfer is an electronic method of transferring funds between individuals or entities through financial institutions. For information on wire transfers, visit our wire transfers page.

Book an appointment at any Bank of Hawaii branch to complete a wire transfer. For more information on what is needed to complete a wire transfer, visit our wire transfers page.

If you have had no activity on your checking account for 12 months, or on your savings account for 24 months, your account is considered inactive. You may reactivate an inactive account by doing one of the following:

We will charge your account a monthly inactive fee starting the month after you receive an inactive notice if your account has not been reactivated. For additional details, you may reference your fee schedule and account agreement found on the Agreements and Disclosures page.

1 Balance inquiry option is not available for Guam, Saipan and Palau accounts.

2 These options are not available for Saipan accounts due to applicable local law.

We understand that losing a loved one is an incredibly emotional and challenging time. In addition to the grief, there are often many practical matters that need attention — and we want you to know you're not alone.

At Bank of Hawaii, we’re here to support you with care and compassion. To help guide you through this process, we invite you to read our article, “Steps After Losing a Loved One” and use our “When a Loved One Passes” guide as a helpful checklist.

Once you’ve gathered the necessary documents, you can schedule an appointment at a Bank of Hawaii branch through BOH.com. Our team is here to provide personalized support and help ease the burden during this difficult time.

Bank of Hawaii Bill Pay makes paying your bills easy and convenient. All you need to do is add your payees (individuals or businesses); then you can make a payment from your computer or your mobile device anytime, anywhere! Learn more about Bill Pay here.

With our one-time payment option, you can make a single payment to your Bank of Hawaii personal and business loans, lines and leases as well as mortgages and home equity lines of credit. You don’t need to enroll in online or mobile banking, or create a log in or password. You simply enter your account information, the amount you want to pay and the payment date. You can pay from any checking or savings account at any bank in the US. If you want to make another payment, simply repeat the process. Make a payment here.

Applicants can use our App Tracker to check the status of their home equity line of credit application. View App Tracker.

You can log into your home equity line account through online banking. If you still need to enroll in online banking, you can sign up here. You can also manage your accounts by visiting your local branch or calling us at 808-643-3888 (Hawaii), 1-877-553-2424 (Guam and Saipan), or 1-888-643-3888 (U.S. Mainland and Canada).

Visit your local branch or call us at 808-643-3888 (Hawaii), 1-877-553-2424 (Guam and Saipan), or 1-888-643-3888 (U.S. Mainland and Canada).

Your account balance is made up of all posted credit and debit transactions. It’s the amount you have in the account before any pending charges are added.

Your available balance is the amount you can use for purchases or withdrawals. It's made up of the account balance minus pending debit card authorizations and holds on funds. Items not reflected in your available balance include, but aren't limited to:

Contact your local branch for information on changing the name on your checking and savings accounts.

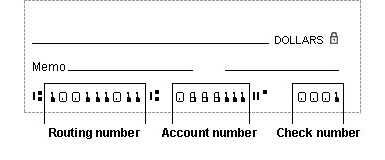

Bank of Hawaii routing numbers:

Domestic Wires

International Wires (SWIFT Code)

Deposit Slips

Electronic Debits / ACH

The sample graphic below shows where the Bank of Hawaii routing number can also be found on your checks.

If you use another financial institution (with online log-in) to fund your new account, your information is secured and protected through BOH’s partner MX (privacy policy). Any data you share with MX will be governed by their privacy policy. Credentials are used on a tokenized basis and are not seen by BOH. The tokenized credentials and bank information, such as bank routing number and account number, will only be stored by MX until the application is submitted or is deleted at the end of the day, whichever is sooner.

Contact our customer service specialists at 808-643-3888. In addition you can also change your ATM pin at any Bank of Hawaii ATM by following the instructions on the prompts.

The easiest way to activate your card is by calling our automated system at 1-877-353-0956.

Learn more about Card Controls here.

If your card is lost or stolen or you spot anything unusual, please call the police or notify us by calling our Customer Service Center at 808-643-3888 or toll-free at 1-888-643-3888.

Call us at 1-877-623-7008 to set travel notifications.

*Bank of Hawaii Time Deposit Account

Choose from in-person or phone appointments at a time and location that’s convenient for you.

Click here to visit our credit card page and find ways to manage your credit card with Barclays.

The Servicemembers Civil Relief Act (SCRA) was enacted in 2003 to support members of the military and their families with the financial challenges of military finances during active duty. Bank of Hawaii can help you understand your rights as they relate to key provisions of this law. But it’s important to understand that you’re not automatically covered for all of the protections. After you are called to active duty, you must formally request that certain SCRA provisions apply to you. Contact your local branch for details.

Read through our privacy policies in our Privacy Center and access our Terms of Service here.

Bank of Hawaii has partnered with Zelle to make banking more convenient for you. Now, there’s a quick and easy way to send money to and receive money from friends and family members who have a bank account in the U.S. Learn more about Zelle here.

Three credit bureaus, Experian, TransUnion and Equifax, collect data on your spending and repayment habits. You can get a copy of your report at each of the bureaus' individual websites. The bureaus are required to share your report with you for free once a year.

Links to other sites are provided as a service to you by Bank of Hawaii. These other sites are neither owned nor maintained by Bank of Hawaii. Bank of Hawaii shall not be responsible for the content and/or accuracy of any information contained in these other sites or for the personal or credit card information you provide to these sites.