Equity—the Ace up your Sleeve

Reading time: 4 Minutes

February 4th, 2025

Owning a home comes with many positives. It's a place to live, of course, one that you're free to upgrade and customize however you like. It's a place to raise a family, and have friends over for celebrations. But a home is also a great investment tool—a way to build your wealth and your purchasing power over the years you own it. That's because of something called equity, which can build up in your home the longer you own it. What is home equity? And what can you do with it?

Here's a quick guide to how equity works and why it's so valuable.

What is home equity?

Simply put, home equity is the difference between your home's value and the amount you owe on your mortgage. There are two ways to build equity:

- Paying down the principal balance of your mortgage. Each month, part of your mortgage payment pays down the loan's principal balance and a portion goes toward interest. As your balance goes down, your equity goes up. Making extra principal payments helps you gain equity faster.

- Increases in your home's value. Over time, the housing market fluctuates, and so does your home's value. When home prices in your area increase, your home's value may rise as well, giving you more equity in your home. Home improvement projects can also increase the value of your home and help you build equity.

How do you calculate home equity?

To figure out how much equity you have in your home, you need two pieces of information:

- The amount you owe. This includes your mortgage balance and any home equity loans or lines of credit that are secured by your home. You can usually find your current balance on your most recent loan statement or by logging into your account online.

- The market value of your home. Various online tools can help you estimate your home's value, but keep in mind that these are just estimates. A home appraisal may be necessary to get a more accurate number.

Subtract the total you owe from the home's value to determine how much equity you currently have in your home.

How to use home equity

One of the benefits of building home equity is that you can leverage that equity when you want a relatively inexpensive option for borrowing money.

When you borrow against your home's equity, the debt is secured by your house. This means that lenders have a secured interest in your home and are usually willing to offer lower interest rates on home equity loans than personal loans and other types of unsecured debt. This also means, however, the lender may foreclose on the property if you stop making payments.

Some of the smart ways you can use home equity include:

- Paying for home renovations

- Consolidating high-interest debt

- Funding the down payment for a second home or investment property

- Paying for the cost of education

How to access your home equity

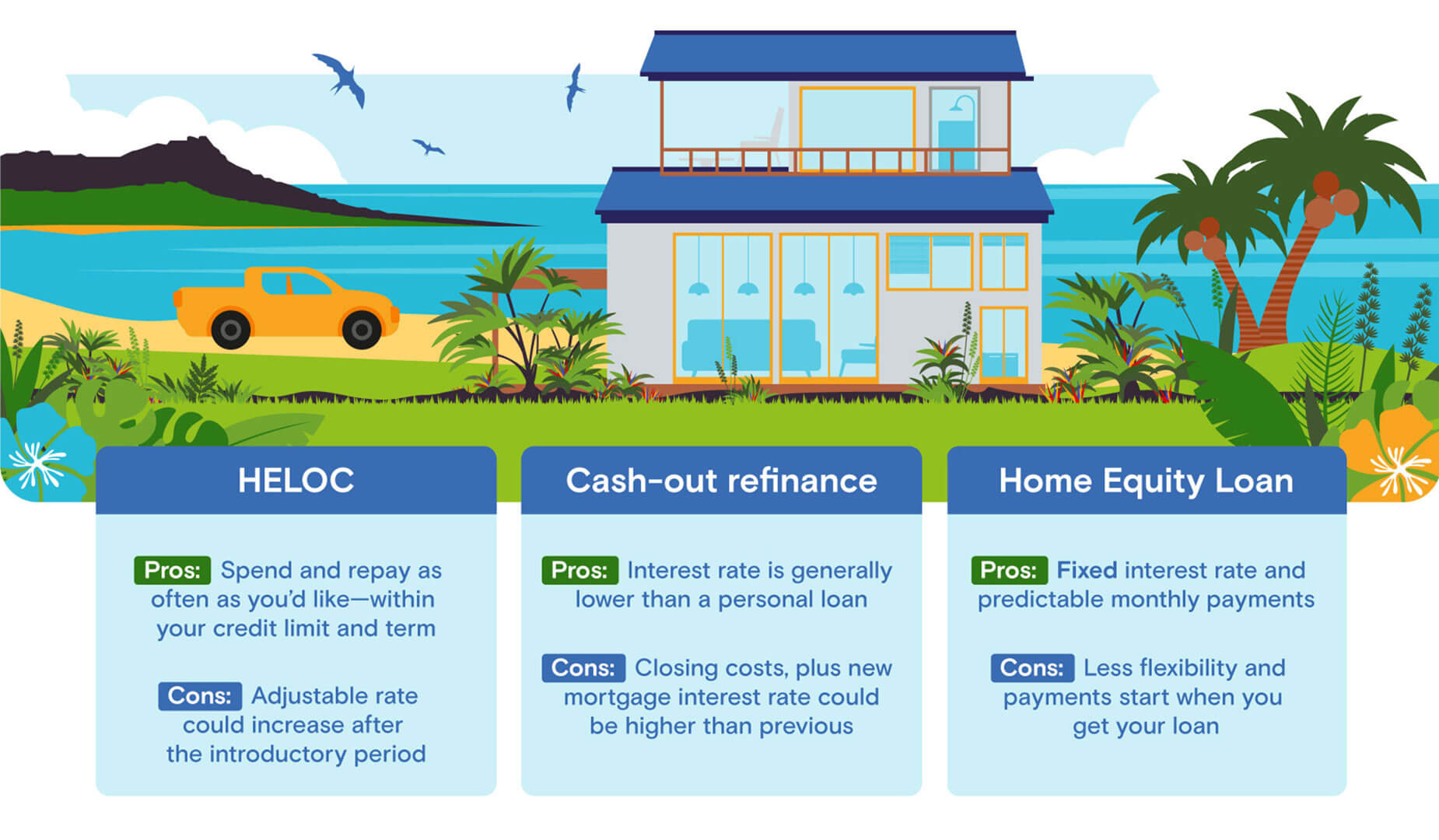

If you're interested in tapping into your home's equity, there are several ways to access it.

Home equity line of credit

A home equity line of credit (HELOC) is similar to a mortgage in that your home is used to secure the loan in that you keep your existing mortgage. However, HELOCs act as revolving credit—you can borrow and repay funds repeatedly, up to your credit limit, over a set period.

HELOCs are typically set up as adjustable-rate loans, with a low introductory rate to get you started. However, at some point you may want to convert some or all of the balance on your adjustable-rate HELOC to a fixed-rate loan option (FRLO). This ensures your interest rate won't change for a specified term and protects you from rising interest rates. It will, however, reduce the amount you are able to draw on your HELOC.

Lenders typically limit the amount you can borrow with a HELOC to 85 percent of your home's appraised value, minus the balance of your existing mortgage.

When considering either a home equity loan or a HELOC, keep in mind that both of these kinds of financing may have higher interest rates than what is available on your primary mortgage. They also often come with a variable or adjustable interest rate, meaning that your rate could go up in the future.

Cash-out refinance

A cash-out mortgage refinance replaces your existing mortgage with a new, larger mortgage. You get the difference between the old loan and the new loan in cash. Your new loan may have a different interest rate and a longer or shorter loan term.

Generally, lenders limit cash-out refinances to no more than 80 percent of your home's value.

Home equity loan

A home equity loan lets you keep your existing mortgage and also take out a second mortgage against your home's equity. You repay the loan with equal monthly payments over a fixed term.

The amount you can borrow with a home equity loan is usually limited to 85 percent of your home's equity.

Now that you know how you can use your home's equity, take the next step to reach your possible and get started today. Learn more about your home equity options or book an appointment with one of our local lending experts.

You're about to exit BOH.com

Links to other sites are provided as a service to you by Bank of Hawaii. These other sites are neither owned nor maintained by Bank of Hawaii. Bank of Hawaii shall not be responsible for the content and/or accuracy of any information contained in these other sites or for the personal or credit card information you provide to these sites.