3 Smart Ways to Maximize Your Savings in 2025

Reading time: 6 Minutes

August 5th, 2025

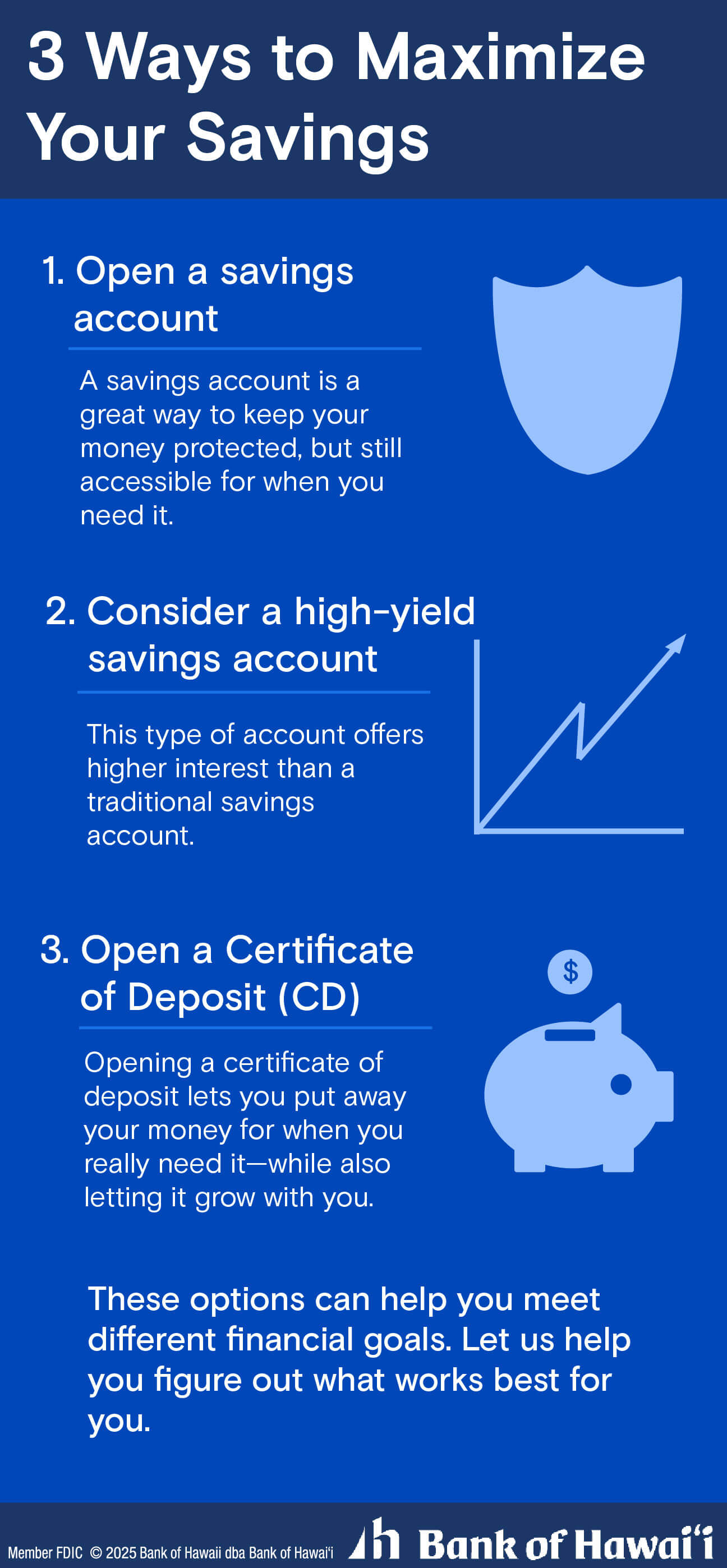

In today’s fast-changing financial landscape, knowing how to maximize your savings is more important than ever. Whether you're preparing for unexpected expenses, planning a big purchase, or simply building a stronger financial foundation, choosing the right savings strategy can make a big difference.

At Bank of Hawaii, we’re here to help you reach your possible and make informed decisions. Here are three approaches that can help you grow your savings—safely and strategically.

1. Open a High-Interest Savings Account for Flexibility and Growth

A savings account is one of the most accessible and secure ways to start saving. It’s ideal for short-term goals and emergency funds, offering:

- FDIC insurance up to $250,000 per depositor, per ownership category

- Easy access to your funds when you need them

- Low or no fees on select accounts when requirements and conditions are met

- Interest earnings that help your money grow over time

While traditional savings accounts offer modest returns, high-interest savings accounts—especially those offered online or through promotional rates—can significantly boost your earnings.

Best for:

- Emergency funds

- Short-term savings goals

- Anyone who wants liquidity and peace of mind

Pro tip: Set up automatic transfers from your checking account to build your savings consistently.

2. Use Certificates of Deposit (CDs) for Higher, Guaranteed Returns

If you’re able to set aside money for a fixed period, a Time Deposit Account/Certificate of Deposit (CD) can offer a higher, guaranteed interest rate than a standard savings account.

Here’s how it works:

- You choose a term (e.g., 6 months, 1 year, 5 years)

- You deposit a fixed amount

- Unlike savings accounts which have a variable interest rate, with a CD, you earn a locked-in interest rate for the duration of the term

CDs are a great option when you don’t need immediate access to your funds and want to protect your savings from market volatility.

Best for:

- Medium-term savings goals

- People who want a predictable return

- Those who can leave their money untouched for the term

Pro tip: Consider a CD laddering strategy to maintain flexibility while maximizing returns.

3. Diversify with a Balanced Savings and Investment Strategy

While savings accounts and CDs are excellent for security and stability, they may not keep pace with long-term inflation. That’s why many savers choose to diversify—combining safe savings vehicles with longer-term investments like mutual funds, bonds, or retirement accounts. Keep in mind that investment products are not FDIC insured, not bank guaranteed, not a deposit, and may lose value, including loss of principal.

A diversified approach can help you:

- Protect your principal with insured savings

- Grow your wealth through market-based investments

- Adapt to changing economic conditions

Best for:

- Long-term financial goals (e.g., retirement, education, homeownership)

- Savers looking to balance risk and reward

- Anyone ready to take the next step in their financial journey

Pro tip: Connect with a Bank of Hawaii localist specialist to create a plan for your unique needs.

Start Saving Smarter Today

No matter where you are in your financial journey, the right savings strategy can help you reach your goals faster—and with greater confidence.

Bank of Hawaii offers a full range of savings solutions, from high-interest accounts to CDs and beyond. Our local experts are here to help you choose the best options for your needs.

Ready to take the next step?

Explore our savings accounts or schedule a consultation with a Bank of Hawaii specialist today.

You're about to exit BOH.com

Links to other sites are provided as a service to you by Bank of Hawaii. These other sites are neither owned nor maintained by Bank of Hawaii. Bank of Hawaii shall not be responsible for the content and/or accuracy of any information contained in these other sites or for the personal or credit card information you provide to these sites.