Personal Loan or Credit Card: Which is Right for You?

Reading time: 5 Minutes

March 11th, 2025

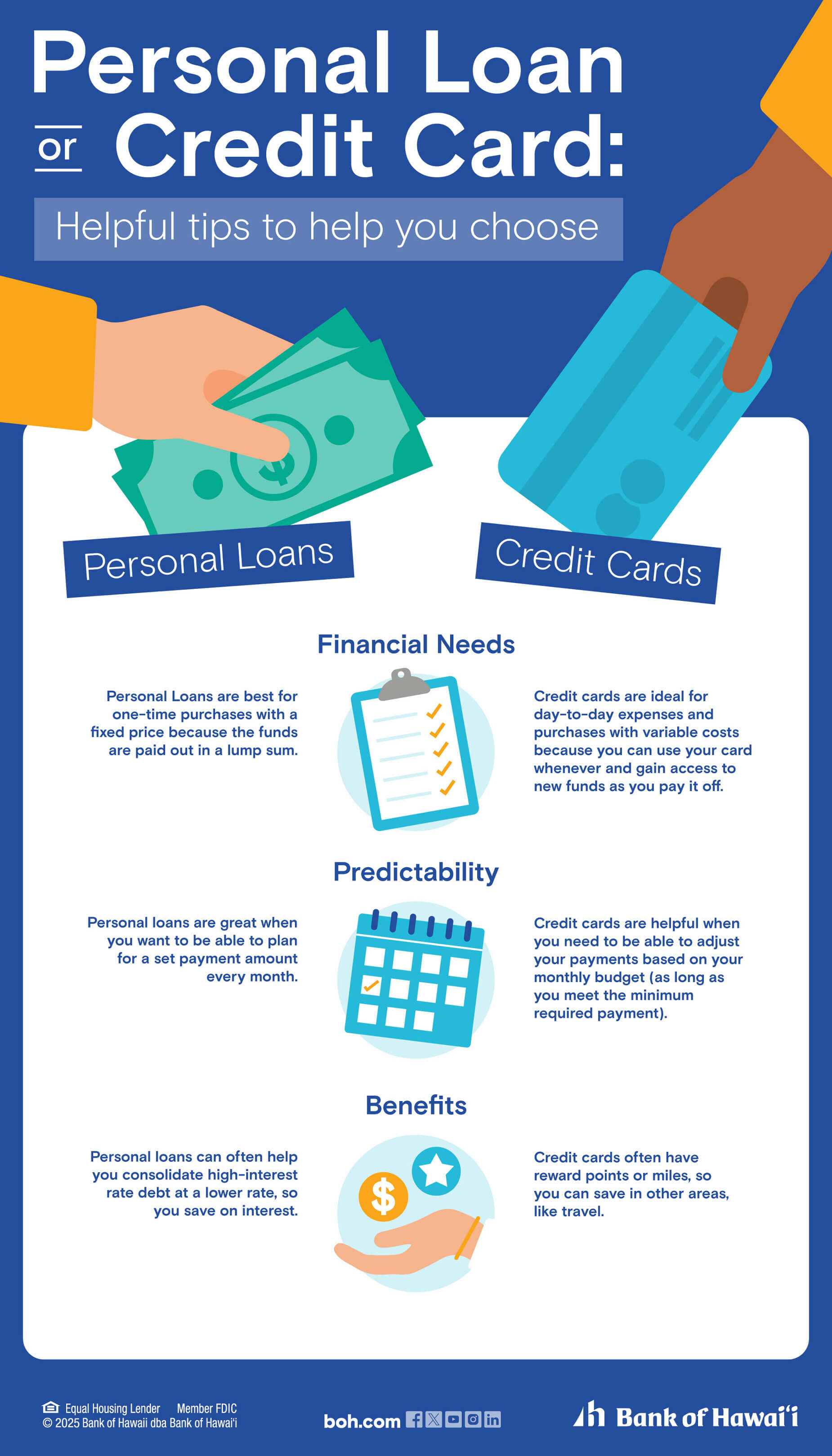

Borrowing money can be useful for accomplishing many things in life, whether it's paying for a big purchase such as a car or family vacation, or using a credit account to easily pay for smaller purchases online.

Two of the most popular ways to borrow money are credit cards and personal loans. Which product works best for your needs will depend on your specific personal situation. Read on to learn more about the basics of how personal loans and credit cards work, and which might be best for different situations.

What is a Personal Loan?

A personal loan is when a financial institution lends money to an individual. That person is then required to pay the money back over an agreed number of monthly payments, as well as interest. This is known as installment credit, or an installment loan.

There are two main kinds of loans, secured and unsecured. With a secured loan, the borrower must put up something as collateral, to act as an insurance policy in case they don't repay the loan. If the borrower defaults, the lender can take possession of the asset, which is usually the item that was purchased with the secured loan—such as a house or a car, but could also be cash stored in a savings account or Certificate of Deposit (CD).

With an unsecured personal loan, no collateral is required. Instead, the lender bases their decision to extend credit on how creditworthy the potential borrower is. This will be based mainly on your credit score, and you'll also be asked to provide personal and employment information, such as pay stubs, a W2 or other proof of income.

If you're approved for a personal loan, you can review the interest rate and terms before signing loan documents to officially accept the money. The cash will then be transferred to your bank account as a lump sum, or given to you as a check. You'll make monthly payments until the loan is repaid in full. There's usually a fixed interest rate and, if you can afford to make larger payments, reputable lenders should allow you to pay off the loan early with no penalty.

Getting an unsecured personal loan means you get the cash up front and can spend it on whatever you want, such as home repairs, a big purchase, or to consolidate high-interest credit card debt.

Credit Card Basics

Unlike a personal loan, which allows you to borrow a single amount of money, a credit card works more like an ongoing line of credit. You can borrow a little money at a time, as you need it, and pay it back as you go. This is why credit cards are known as revolving credit.

You can choose to pay off your credit card in full every month, or pay a lesser amount (as little as the minimum required payment listed on your credit card statement), and roll over the balance to the next month. You'll pay interest on the balance, but you can keep borrowing more money until you hit your credit limit.

Like personal loans, credit cards are usually unsecured. People with good credit ratings might qualify for a lower interest rate or special promotions, but if you have fair or poor credit, you may have higher interest rates.

Credit cards can be used for in-person and online purchases, to get cash (for an extra fee), or even to transfer over existing balances from other credit cards (usually for a fee). (This is called debt consolidation, or balance transfer, and you'll typically do this if your new card has a lower interest rate than your older cards, in order to save money.) Other credit card benefits can include special programs that offer cash back, points toward discounts, or travel rewards.

Reasons You Might Choose a Personal Loan

Regular monthly payments: Knowing up front how much your payment will be every month, and when the loan will be paid off, can make it easier for you to budget and repay your debt in a disciplined manner.

Lower interest rates: This will vary depending on the specific lender and borrower, but in general, you can expect personal loans to have lower interest rates than credit cards. If you're borrowing more money than you can repay in a month, a personal loan will likely end up being cheaper than a credit card.

Higher borrowing ability: If you need to make a large purchase, you may have better luck qualifying for a personal loan than a high-limit credit card.

A credit score boost: A personal loan can actually improve your credit score. If you make all your payments on time and repay the full amount per the terms of the loan, you'll build your credit history. Good credit-card usage will do this, too, of course, but a personal loan can create more diversity in the types of accounts you have, potentially giving your score an additional boost.

Reasons You Might Choose a Credit Card

Convenience: Once you've been approved for a credit card, that's it, you're free to make as many purchases as you like without jumping through any more hoops (up to your limit, of course).

Potential low-cost: Responsibly used, a credit card can be a low or even no-cost way to borrow money. If you pay off your balance in full every month, you won't have to pay interest on it. (Pay attention to other fees though, such as any annual fee.)

Flexibility: It's usually a good idea to pay off the balance of your credit card, to avoid interest, but if you ever have a tight budget, a credit card will allow you to repay a much smaller amount for that month without getting into any trouble with your lender.

Accessibility: If you have bad credit, you may still be able to get a credit card even if you don't qualify for a personal loan. If you are having trouble getting approved, look into a secured credit card, which will have you put down a refundable security deposit, which then becomes your credit limit.

Both credit cards and personal loans are important tools that can help you access credit when you need it. By understanding how they work and the benefits they offer, you can pick the right option for your needs.

Have more questions? Learn more about credit cards or personal loans at Bank of Hawaii.

Find the Right Solution for You

We’re here to help you navigate your options. Whether you’re consolidating debt, managing expenses, or funding a big purchase, our specialists can guide you to the right solution that works for your lifestyle and goals.

You're about to exit BOH.com

Links to other sites are provided as a service to you by Bank of Hawaii. These other sites are neither owned nor maintained by Bank of Hawaii. Bank of Hawaii shall not be responsible for the content and/or accuracy of any information contained in these other sites or for the personal or credit card information you provide to these sites.