Joint vs. Separate Bank Accounts for Couples: How to Choose

Reading time: 5 Minutes

January 14th, 2026

When you're in a romantic relationship, talking about money is essential. As a team, you'll need to decide: do we want to manage our money together or separately? There's no right or wrong answer—but it's important to find the right fit for your relationship.

How Joint Accounts Work

Joint bank accounts are a type of bank account that allows more than one person to access funds and manage the account. Checking and savings accounts can both be joint accounts.

Account owners can include spouses, partners, or significant others. Everyone named on the account has equal access to the money, regardless of who opens the joint account or deposits funds.

The Federal Deposit Insurance Corporation (FDIC) and the National Credit Union Administration (NCUA) provide $250,000 of federally backed insurance coverage per depositor, per FDIC insured bank or NCUA insured credit union, per ownership category, in case of bank failure. So a joint account with two owners receives up to $500,000 of deposit insurance instead of $250,000 for an individual account. *

Best Bank Account Options for Couples

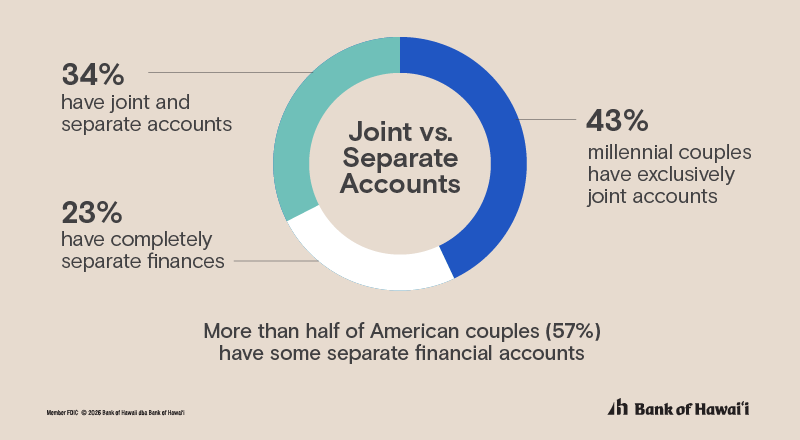

Traditionally, most married couples combined their finances in a joint bank account. But today, only 43% of couples use exclusively joint accounts. Many couples now create unique systems tailored to their needs.

Let’s explore the pros and cons of each approach.

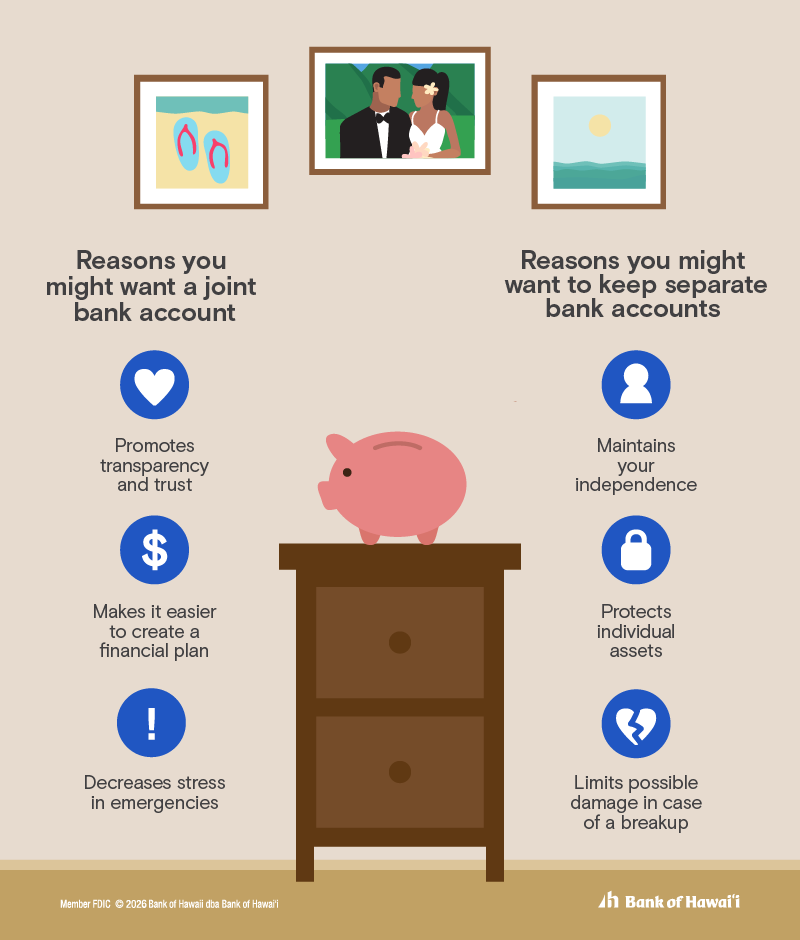

Pros of Joint Accounts

- Promotes Transparency and Trust: Joint accounts encourage open communication. Transactions are visible to both partners, helping build accountability and reduce financial secrecy.

- Simplifies Financial Planning: Paying shared bills and budgeting becomes easier when everything is in one place.

- Emergency Access: Either partner can access funds in urgent situations, such as medical emergencies or unexpected repairs.

Cons of Joint Accounts

- Loss of Financial Independence: Some may feel a lack of privacy with shared accounts.

- Asset Protection Concerns: Joint balances can affect financial aid eligibility or Medicaid qualification.

- Complications During Breakups: If a relationship ends, joint accounts can become a legal and emotional battleground.

When to Consider Separate Accounts

- Maintain Autonomy: Separate accounts allow each partner to manage their own spending.

- Protect Individual Assets: Especially useful if one partner has significant debt or financial obligations.

- Avoid Conflict: Limits potential disputes over spending habits or account access.

Hybrid Account Strategies

A hybrid system combines joint and separate accounts. Here’s how it might work:

- Joint Account: Used for shared expenses like rent, groceries, and utilities.

- Separate Accounts: Each partner has personal spending money for discretionary purchases.

Some couples allocate a monthly “allowance” to their separate accounts, while others use joint accounts only for specific goals like saving for a wedding or vacation.

How to Decide What’s Right for You

Discuss these questions with your partner:

- How will we pay for regular expenses like rent and groceries?

- How will we prepare for emergencies?

- Do we want to simplify our joint costs?

- How will we handle debt payoff?

- How will we save for big life goals (e.g., home buying, college, retirement)?

Related Resources

Ready to Take the Next Step?

Explore your options with a Joint Checking Account or connect with a local expert who can help you.

Streamline your finances together.

Easy and secure banking — all from one account.

This material is provided for educational purposes only and is not intended to be relied upon as research or tax, legal, investment, financial or accounting advice. You should consult your own tax, legal, investment, financial or accounting advisors before engaging in any activities or transactions.

You're about to exit BOH.com

Links to other sites are provided as a service to you by Bank of Hawaii. These other sites are neither owned nor maintained by Bank of Hawaii. Bank of Hawaii shall not be responsible for the content and/or accuracy of any information contained in these other sites or for the personal or credit card information you provide to these sites.