How to Read Your Credit Report

Reading Time: 6 Minutes

September 16th, 2020

When was the last time you ordered your credit report and read through it? If it's been a year or more, or if you've never actually seen your credit report, it's definitely a good idea to order a copy—it's free!—and see what's there. What you find on your report could really impact your future finances.

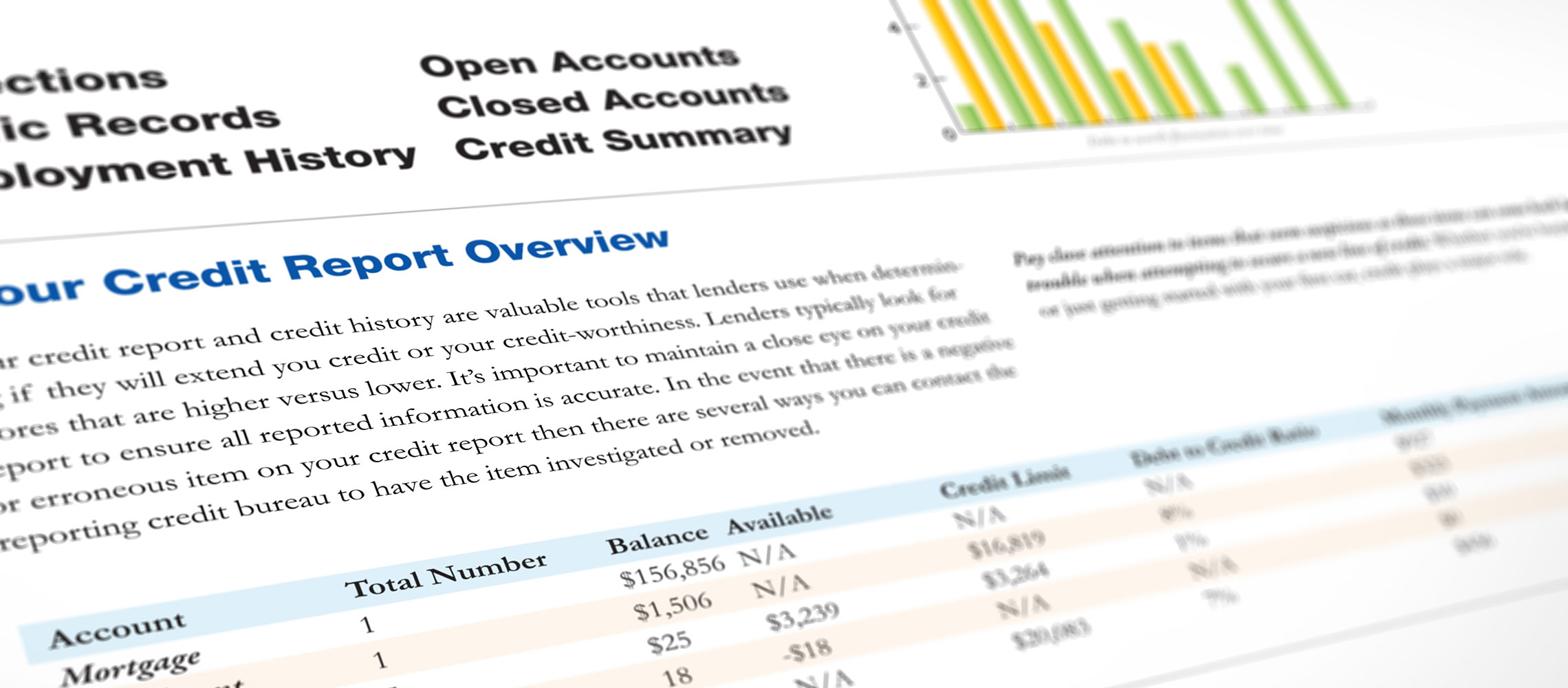

Think of a credit report like a report card. It's a record of a person's credit history, and lenders use it to determine creditworthiness and to help predict future possible delinquency. Credit reports often include personal financial info, such as a list of lending institutions that have issued a line of credit or loans, the total amount of money that was lent, the size of repayment amounts and how often payments were made, as well as missed or late payments, if any.

It's important to regularly review your credit report to check for possible errors and identity theft, as well as to learn more about how you might improve your credit score, which may help in qualifying for future credit cards, buying a home or getting better interest rates on existing debt.

The Fair Credit Reporting Act (FCRA), a federal law enacted to promote the accuracy, fairness and privacy of consumer information contained in the files of consumer reporting agencies, requires each of the three major credit reporting agencies to provide you a free credit report once a year, upon request. If you haven't received your annual credit report recently—or ever—you can order a copy online at annualcreditreport.com (the only website offering free credit reports that is authorized by federal law) or by calling 1-800-322-8228.

Each credit bureau organizes its credit reports differently, but all three will have the same basic elements. If you're unsure how to read your report, here are a few key things to look for:

1. Personal information and accounts

Your free credit report will list personal information, including your name (which may have a few different spellings depending on your marital status, if you've ever used your middle name or middle initial on credit applications and so on), your birthdate, current and previous addresses and phone numbers, your Social Security number (which may be partially masked for security purposes) and your present or past employers.

Your credit report will also list all your credit accounts, with a summary that includes account numbers, the names and addresses of creditors, the date each account was opened, credit limits, types of account (for example, mortgage, credit card or student loan) and the status of each account (whether an account is open or closed, whether your payments have been on time, and so on). You should also see the remaining balance on each account, as well as the date your creditor last sent info to the credit reporting agency.

Some credit reports will include your debt-to-credit ratio, which measures how much of your total approved credit you're actually using. One of the biggest factors in determining your credit score is this credit utilization ratio—another reason to make sure that your total account limits are correct.

In this section, look carefully for any personal or account info you don't recognize or that is wrong. While it is normal for credit reports to not list every single past employer or old phone number, and while even the exact balance of your accounts or credit cards might not be completely up to date on the day you receive the report, be wary of home addresses, bank accounts or loans you don't recognize. These types of irregularities suggest that someone else may have used your personal info to fraudulently open accounts in your name. If you believe you might be the victim of identity theft, contact the Federal Trade Commission (FTC) online at identitytheft.gov or by phone at 1-877-438-4338.

2. Credit inquiries

Whenever you apply for a new credit card, a credit limit increase, a loan or a mortgage, banks and other lending institutions will check your credit report to see if you've been applying for credit with other companies.

In general, there are two types: Hard inquiries happen when an individual authorizes a potential creditor to make an inquiry into their credit as part of an application. Hard inquiries may cause a temporary dip in your credit score, particularly if you have more than a few listed on your report, as it can be an indication that you're in financial distress.

Soft inquiries usually occur when an individual checks their own credit or a potential creditor offers someone a promotional offer. This kind of inquiry doesn't typically affect credit scores.

Any inquiries listed on your credit report should include the date of inquiry, as well as the name and address of the inquiring organization. (Hard inquiries should be authorized by you, and should fall off your report after two years.)

3. Negative information (if any)

Negative information includes delinquent accounts which have not been paid as agreed, debt that has been sent to collections and public records, such as bankruptcies. Negative credit report entries may lower a person's credit score and make it more difficult to get approved for credit and loans in the future. However, having a negative mark on your report isn't the end of the world: Negative info generally remains on credit reports for seven years; Chapter 7 bankruptcies can remain on reports for a decade. After that, the information will fall off the report, and your score will likely rebound.

What to do if you find an error

It's critical that all information in your credit report, especially negative info, is accurate. If there are inaccuracies—for example, if your payment history shows a late payment when you actually paid on time, or a collection has gone beyond its statute of limitations but is still listed on your credit report—dispute the info immediately by submitting a letter, copies of documentation supporting your case and any required proof of your own identity to the credit bureau, either online or via mail.

You can also submit a dispute directly with the business that reported the error to the credit reporting agency; both organizations are required to conduct an investigation and respond within 30 days, according to the Fair Credit Reporting Act. (Due to the COVID-19 pandemic, the Consumer Financial Protection Bureau is temporarily allowed 45 days.)

In the meantime, while a dispute is being processed, individuals can continue to build credit by making timely payments on open and active accounts.

Reading and understanding your credit report is just the first step on the road to increasing your financial health. Once you start identifying areas of your personal finances that you can improve, you can work to start raising your credit score, which will put you in a better position to accomplish your goals.

You're about to exit BOH.com

Links to other sites are provided as a service to you by Bank of Hawaii. These other sites are neither owned nor maintained by Bank of Hawaii. Bank of Hawaii shall not be responsible for the content and/or accuracy of any information contained in these other sites or for the personal or credit card information you provide to these sites.