#CoupleGoals: How to Talk about Money with Your Significant Other

Reading time: 5 Minutes

March 1st, 2024

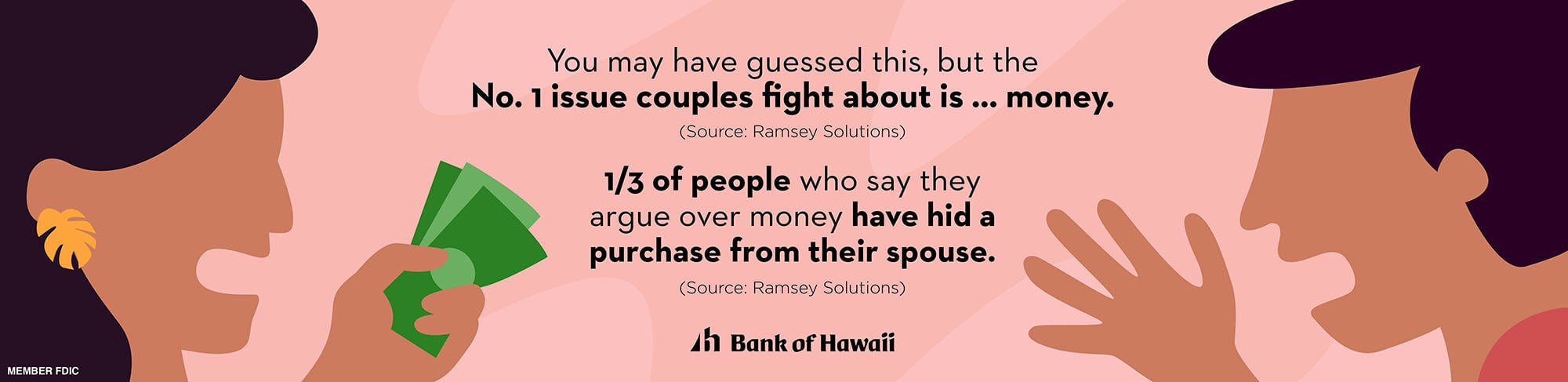

Money may talk, but it's still a touchy subject–especially when it comes to relationships. If you're starting to get serious with a partner, there are a whole slew of topics to tackle: What are your shared hopes and dreams? What are your shared values? Do you want kids? Finances can end up affecting almost all of these topics—and more!

It's understandable if you feel a bit overwhelmed at the prospect of diving into such a potentially sensitive and awkward topic with your significant other. The good news? Once you normalize having open, honest discussions around money, budgeting and financial planning, it will get easier and easier to confront challenges, achieve your goals and build a future, together.

Start Small

The two of you are not going to become an accounting powerhouse overnight, especially if your relationship is still new, or if you or your partner have a hard time being open about finances. Ease into your financial discussion with small steps.

Try to make it fun at first! Planning together how you're going to bum around Thailand, or splurge for Valentine's Day, can be much more appealing than starting off with the phone bill.

As you get more comfortable talking about how to reach shared money goals, you can start going bigger: grocery shopping together, splitting big bills, agreeing on ways you both can optimize your budgets.

One easy step to take is to open a joint checking or savings account to which you both contribute, and use it as a communal pot for purchases like trips together or big dinners out. Once you've got a real-life project to work on, you'll find that the financial discussions will start coming more naturally.

Streamline your finances together.

Easy and secure banking — all from one account.

Be both Honest and Understanding

You've heard this before about relationships, but it's especially key when it comes to money: Be honest. How much do you make? No, how much do you really make? How much do you actually spend a month on non-essential purchases? How much debt do you have? Not sharing your full financial situation will complicate planning, which is bound to not only be frustrating to you and your partner, but also make the process harder down the road.

On the flip side, be understanding with your partner. When you start sharing finances, you're bound to learn some new things. Who knew their Starbucks habit amounted to $300 a month? Or that your significant other was sitting on $25,000 in credit card debt?

Healthy communication means being able to confront and solve problems together; it's not just about flourishing in the good times. Take a deep breath, and start looking for options and solutions. Are you both willing to work to get to a financial position you both consider healthy? If so, how? What can you both do to help each other make progress? This could involve making big changes to your spending habits, consolidating debt with a personal loan, coming up with payment plans or even seeing a therapist together to discuss spending addictions.

Here are a few key topics that you'll want to make sure you cover.

- How much money do we each make?

- Do we expect either or both of our income levels to change in the next few years?

- What kind of debt do each of us have?

- What kind of progress are we making on paying that debt down?

- What do our emergency savings look like?

- Do we want to own a home at some point?

- What are our plans for retirement, and how far along are we in reaching our goals?

- How would we describe our spending styles? Do they match up?

- What are some of our biggest challenges with money?

- What are our big goals in life?

These might seem like very personal, probing subjects to dive into, but just remember it's a back-and-forth conversation between two people who love and trust each other.

Make it Official

One of the reasons it's so easy to push off the big Money Talk is that we all like to avoid awkward confrontations. One way we do that is by keeping things casual. An offhanded mention of how much you'd like to reduce the Amazon purchases each month, for example, or a general comment about eventually buying a condo together.

You might think these casual mentions count as financial discussions, but often they don't end up establishing any concrete goals or untangling any real issues.

Instead, try scheduling a real date and time for your money chat. You can make it fun, by ordering takeout and opening up a bottle of wine while you pull up some spreadsheets in the living room. In any event, plan it out in advance, including the topics you'd like to cover, and plan to come away from your discussion with specific takeaways that both of you can take action on.

The key here is to let everyone mentally prepare for the discussion, think through what their goals and worries are, and be ready to tackle potentially challenging money issues.

Then, once you've had your planning meeting, put that plan down in writing. Share a spreadsheet with all the important information, and track where you are with your joint savings account or debt reduction project. Making it real forces both of you to confront the reality of the situation and start taking action, whether it's small things (saving a little bit each month) or large (drastically downsizing your monthly spending).

Talking about finances may not seem like the most romantic conversation, but being on the same page about your financial future can make that future a lot more fun.

You're about to exit BOH.com

Links to other sites are provided as a service to you by Bank of Hawaii. These other sites are neither owned nor maintained by Bank of Hawaii. Bank of Hawaii shall not be responsible for the content and/or accuracy of any information contained in these other sites or for the personal or credit card information you provide to these sites.