Economic & Market Monitor

For the period ending February 13, 2026

Market Review

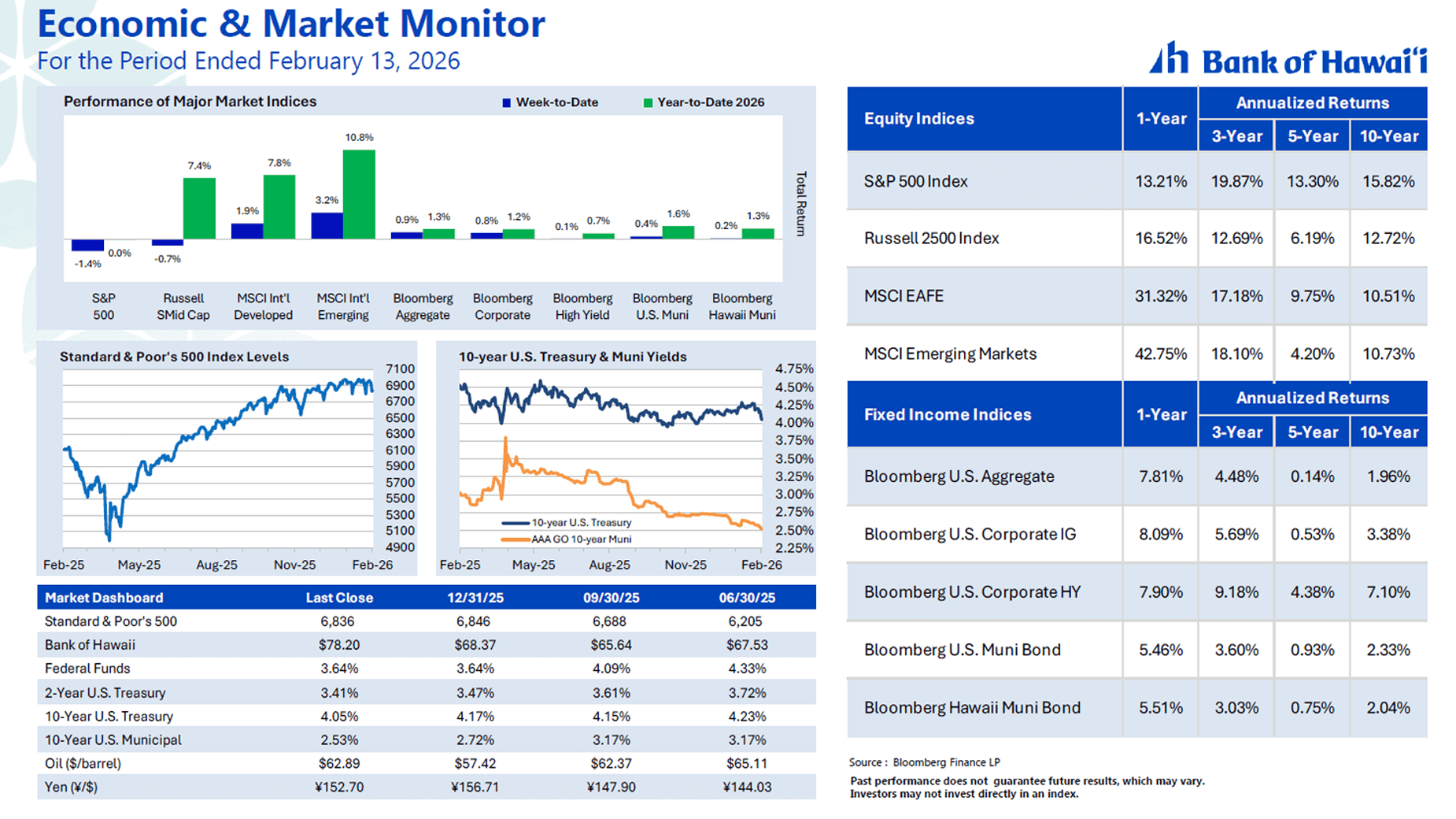

AI Worries Hit U.S. Stocks: The S&P 500 fell 1.4% last week, erasing its year-to-date gains. Investor concern grew that AI driven startups could threaten the profitability of established companies. Losses were broad based, affecting online travel, shipping, commercial real estate management, wealth management, and software.

International markets were largely unaffected. The MSCI Developed Markets Index gained 1.9%, while MSCI Emerging Markets rose 3.2%. Year-to-date returns increased to 7.8% and 10.8%, respectively.

A Good Week for Bonds: Bond markets advanced following favorable January inflation data. The Bloomberg U.S. Aggregate Bond Index gained 0.9%, and U.S. Municipal Bond Index rose 0.4%. Year to date returns reached 1.3% and 1.6%, respectively.

Treasury yields declined across most maturities. The 10-year U.S. Treasury yield ended the week at 4.05%, down 0.16%.

Inflation Cools: The Bureau of Labor Statistics reported that January Consumer Price Index (CPI) rose 2.4% year-over-year, down from 2.7% in December. Core CPI, excluding food and energy, slowed to 2.5% from 2.6%.

Surprisingly Strong January Payrolls: The Labor Department reported that January’s non-farm payrolls jumped 130,000 from a gain of 48,000 reported in December. The Bloomberg consensus forecast for January called for an increase of just 65,000. The unemployment rate edged down to 4.3% from 4.4%, while wage growth remained steady at 3.7% year-over-year.

Consumer Spending Slowed in December: Retail sales were flat in December after rising 0.6% in November. Economists had expected a 0.4% increase.

Double Digit S&P 500 Earnings Growth: As of February 13, more than 70% of S&P 500 companies had reported Q4 2025 results. Nearly 75% exceeded analysts’ expectations. Analysts estimate Q4 year-over-year EPS growth at 13.6%. Full year 2025 EPS growth is projected at 14.3%.

Outlook

The fundamental underpinnings of the financial markets appear solid for 2026. Economists tracked by Bloomberg expect the economy to grow at 2.4%, up from 2.2% last year. Meanwhile, inflation as measured by the Personal Consumption Expenditures (PCE) Core Price Index – the Federal Reserve’s preferred inflation metric – is expected to ease to 2.7% from 2.8%. Analysts estimate S&P 500 EPS growth at just under 15%. If these forecasts materialize, the stock and bond markets should have another good year in 2026.

AI has been a key driver of the stock market’s returns for much of the past three years but since October of last year it has dragged on returns. This has reflected investor concerns that large technology firms such as Microsoft, Alphabet and Meta are spending too much on AI capacity and that AI itself will present a threat to the business models of software companies and, more recently, companies in many other industries. These concerns are largely speculative at this point because the deployment of AI remains in its infancy with its outcomes virtually impossible to predict with any degree of precision. There will undoubtedly be some big AI winners and losers, but the market appears to have become indiscriminate in differentiating between these groups. This is presenting an opportunity for active managers.

December PCE this Week. The Bureau of Economic Analysis is expected to release December Personal Consumption Expenditures (PCE) Core Price Index data on Friday. The report was delayed by the fourth quarter government shutdown. Bloomberg-surveyed economists estimate Core PCE inflation at 2.9% year over year, up from 2.8% in November.

Roger Khlopin, CFA

Chief Investment Officer

Aaron Nghiem, CFA, CIMA

Senior Portfolio Manager

This material is provided for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Bank of Hawaii and its affiliates do not provide tax, legal or accounting advice. This material is not intended to provide, and should not be relied on for, tax, legal, or investment advice. You should consult your own tax, legal, accounting or financial professional before engaging in any transaction. Neither the information nor any opinions expressed herein should be construed as a solicitation or a recommendation by Bank of Hawaii or its affiliates to buy or sell any securities, investments, or insurance products. Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved. Past performance is not a guarantee of future results.

You're about to exit BOH.com

Links to other sites are provided as a service to you by Bank of Hawaii. These other sites are neither owned nor maintained by Bank of Hawaii. Bank of Hawaii shall not be responsible for the content and/or accuracy of any information contained in these other sites or for the personal or credit card information you provide to these sites.