Bankoh Investment Services

Navigate your financial future with confidence with investment strategies and services from a name you can trust.

The Importance of Financial Planning

Meet Chris Otto, a financial adviser and leader in Bankoh Investment Services, who has first-hand knowledge of the importance of financial planning.

Personalized solutions for every need.

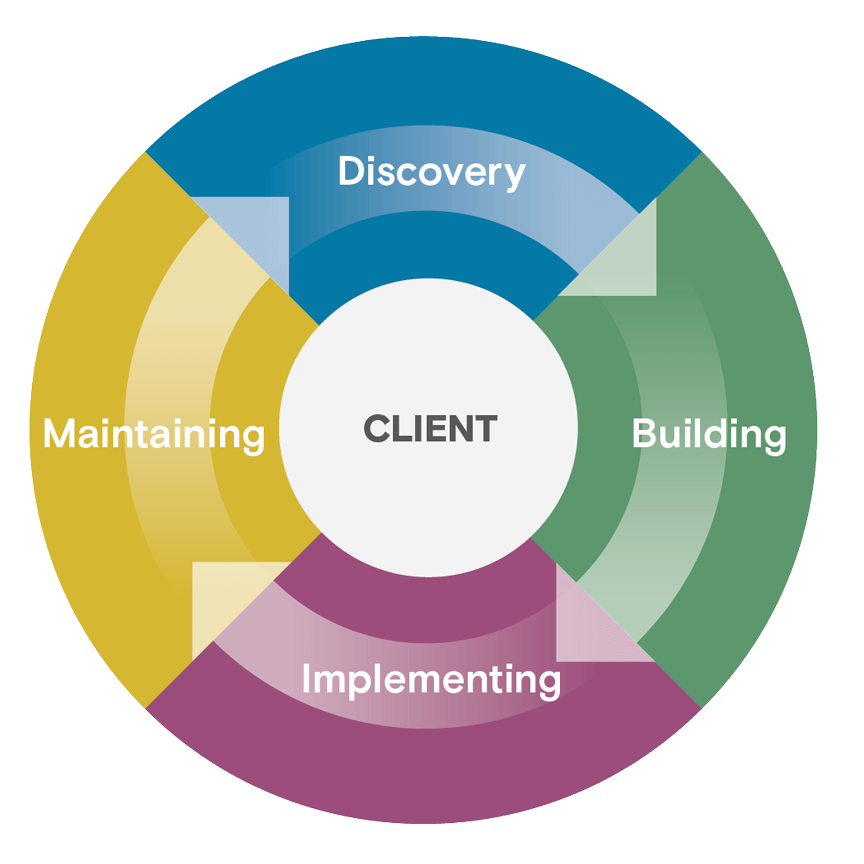

When it comes to planning for your financial future, there is no such thing as one-size-fits-all. At Bankoh Investment Services, we take the time to get to know you and understand your financial needs and goals. We call our process ‘navigation’ because our expert investment specialists thrive on charting the course to success for our clients.

Start with discovery

Every relationship starts with a discovery process to understand your needs, goals and priorities. Then, we’ll work to develop a financial plan that aligns with your overall wealth plan which we’ll regularly review to ensure we’re meeting your current needs and on track to your future goals.

Visit FINRA’s BrokerCheck to learn more about our firm and financial professionals.

Please review our Customer Relationship Summary which important information about our firm, including fees, costs, conflicts of interest, and the services we offer that can help you decide if we are right for you.

Get More with Bankoh Investment Services

Build a financial plan

Build a financial plan

A financial plan helps you define your needs and goals—and helps set the course to reach them. Schedule a free consultation with a financial advisor

-

Investment strategies

-

Insurance policy analysis

-

Retirement planning

Grow your wealth

Grow your wealth

To learn how we can help you grow your wealth, schedule a free consultation with one of our financial advisors today. Learn more

-

Investment strategies

-

Market monitoring

-

Risk tolerance exploration

Protect your assets

Build a financial plan

Protect your future and the people you love the most. To schedule a free insurance analysis, talk to a Bankoh financial advisor today. Learn more

-

Life insurance

-

Disability Insurance

-

Business Insurance

Thought Leadership & Insights

Explore market information and expert insights from our strategists and advisors.You're about to exit BOH.com

Links to other sites are provided as a service to you by Bank of Hawaii. These other sites are neither owned nor maintained by Bank of Hawaii. Bank of Hawaii shall not be responsible for the content and/or accuracy of any information contained in these other sites or for the personal or credit card information you provide to these sites.