Checking Account Monthly Service Fees

We're introducing new ways to waive your monthly service fees, your way.

Thank you for banking with us. Below are the checking account monthly service fees effective October 1, 2024. We have flexible ways to qualify for waived fees based on your average daily balance, direct deposits, and more!

Monthly Service Fees, effective 10/1/2024

| Monthly Service Fees |

|

Ways to Waive Fees | |

|---|---|---|---|

|

EASE by Bank of Hawaii |

$3.251 |

Minimum average daily Ledger Balance2 of $200 or any Direct Deposit3 |

|

|

Convenience |

$5 |

Minimum average daily Ledger Balance2 of $500 or total minimum Direct Deposits3 of $500 |

|

|

Bankohana I |

$15 |

Combined Bankohana balances4 of $6,000 |

|

|

Bankohana II |

$25 |

Combined Bankohana balances4 of $20,000 |

|

|

Bankohana III |

$30 |

Combined Bankohana balances4 of $50,000 |

1 Fee waived for accountholder while under 18 years of age. Applies only for sole account ownership. Determination of eligibility is based on information given at account opening.

2 The average daily Ledger Balance will appear on your statement as “Average balance”.

3 Direct Deposit is define as an electronic deposit made through the ACH network to your Account by someone else, such as an employer issuing payroll or a government paying benefits made during a monthly cycle.

4 For a full list of accounts that may be used to meet the combined balance requirement, review the Bankohana Benefits and Requirements document.

Helpful tips for managing your checking account

Check your average daily Ledger Balance

You may already be meeting the average daily Ledger Balance needed to waive your monthly service fee. If you’d like to check what your last average daily Ledger Balance was, check your statement under “Average balance”.

Set up your direct deposit

Not only can direct deposits help get your monthly service fee waived for certain accounts but setting up direct deposit can help you grow your balance and ensures you can access your funds on the same day they’re deposited.

Consolidate your checking accounts

Do you have multiple Bank of Hawaii checking accounts? Consolidating your accounts can make it easier to manage your funds and help you reach the balance requirements needed to waive your monthly service fee.

Frequently Asked Questions

Why are my monthly service fees changing?

We value you as a customer and understand your concern regarding the increase. We are constantly reassessing our fees, and this adjustment allows us to maintain our commitment to delivering exceptional value in a competitive environment. It is never an easy decision to increase fees, but our new fees remain comparable to local peer banks and lower than national banks. In addition, however, we made it easier to obtain a monthly service fee waiver by either making qualifying direct deposits (specifically for EASE and Convenience Checking accounts) or maintaining a minimum balance.

How can I find out which checking account I have?

Your checking account type can be found by logging into your mobile app or online banking account on your laptop, tablet, or mobile device. You can also check your statement.

How is my average daily Ledger Balance calculated?

Your daily Ledger Balance is the balance of your checking account at the end of each day. Your average daily Ledger Balance is calculated by adding up the end of day balances on your account and then dividing that by the amount of calendar days in your statement period.

For example, the minimum average daily Ledger Balance requirement for EASE is $200. If you maintain $250 in your account for 20 days in the statement period and $195 in your account for 10 days of the statement period, you average daily balance will be $231.66. In this example, your monthly service fee would be waived for that statement period.

Your checking account balance may fluctuate over and under the minimum amount during the statement period. As long as your average is over the minimum requirement, your monthly service fee will be waived.

How can I find out what my average daily Ledger Balance is?

Check your last statement to find your previous month's average daily Ledger Balance reflected as "Average balance". This will vary each month depending on your account balance.

What is considered a Direct Deposit?

Direct Deposits are electronic deposits made through the ACH network to your Account. The most common Direct Deposits are: paychecks, monthly government checks like social security, and electronic payments coming from another financial institution.

How can I check to see if a transaction is considered a Direct Deposit?

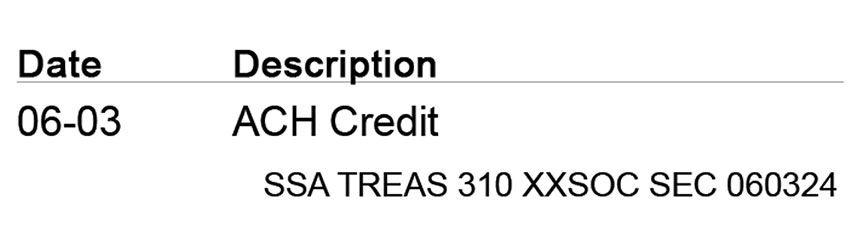

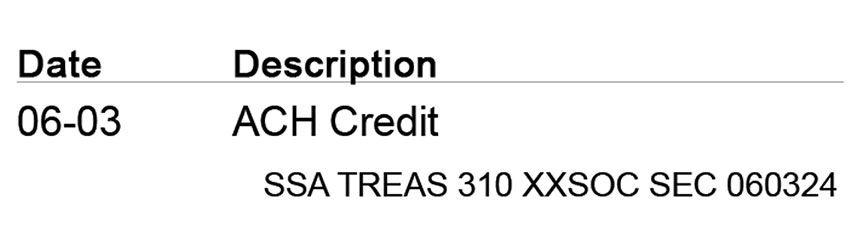

You can check your statement. If a transaction is labeled as “ACH Credit” it is considered a Direct Deposit.

Here is an example of what an ACH credit may look like on your statement:

Will a peer-to-peer (P2P) transaction (such as Venmo) qualify as a Direct Deposit?

It may. You can review your transaction history on your statement or through Mobile & Online Banking. If the P2P transaction is showing as an “ACH Credit” on your statement, it qualifies as a direct deposit.

Are there any exceptions regarding monthly service fees for minors?

Yes, for EASE by Bank of Hawaii accounts, the monthly service fee is waived for accountholders while under 18 years of age. This applies only for sole account ownerships.

How do I know if my monthly service fee change is effective on October 1, 2024 or January 1, 2025?

If you had a Free Checking account that was converted into a Convenience Checking account in May 2015, your monthly service fee change will go into effect on January 1, 2025 instead of October 1, 2024.

I would like to know more about the monthly service fee changes.

For more information, see the Changes to the Bank of Hawaii Consumer Checking and Savings Account Fee Schedule.

What if I want to change my account based on the monthly service fee changes?

We’re happy to help you find a checking account that will meet your needs. Book an appointment with a banker to learn more about your options.

Why are my monthly service fees changing?

We value you as a customer and understand your concern regarding the increase. We are constantly reassessing our fees, and this adjustment allows us to maintain our commitment to delivering exceptional value in a competitive environment. It is never an easy decision to increase fees, but our new fees remain comparable to local peer banks and lower than national banks. In addition, however, we made it easier to obtain a monthly service fee waiver by either making qualifying direct deposits (specifically for EASE and Convenience Checking accounts) or maintaining a minimum balance.

How can I find out which checking account I have?

Your checking account type can be found by logging into your mobile app or online banking account on your laptop, tablet, or mobile device. You can also check your statement.

How is my average daily Ledger Balance calculated?

Your daily Ledger Balance is the balance of your checking account at the end of each day. Your average daily Ledger Balance is calculated by adding up the end of day balances on your account and then dividing that by the amount of calendar days in your statement period.

For example, the minimum average daily Ledger Balance requirement for EASE is $200. If you maintain $250 in your account for 20 days in the statement period and $195 in your account for 10 days of the statement period, you average daily balance will be $231.66. In this example, your monthly service fee would be waived for that statement period.

Your checking account balance may fluctuate over and under the minimum amount during the statement period. As long as your average is over the minimum requirement, your monthly service fee will be waived.

How can I find out what my average daily Ledger Balance is?

Check your last statement to find your previous month's average daily Ledger Balance reflected as "Average balance". This will vary each month depending on your account balance.

What is considered a Direct Deposit?

Direct Deposits are electronic deposits made through the ACH network to your Account. The most common Direct Deposits are: paychecks, monthly government checks like social security, and electronic payments coming from another financial institution.

How can I check to see if a transaction is considered a Direct Deposit?

You can check your statement. If a transaction is labeled as “ACH Credit” it is considered a Direct Deposit.

Here is an example of what an ACH credit may look like on your statement:

Will a peer-to-peer (P2P) transaction (such as Venmo) qualify as a Direct Deposit?

It may. You can review your transaction history on your statement or through Mobile & Online Banking. If the P2P transaction is showing as an “ACH Credit” on your statement, it qualifies as a direct deposit.

Are there any exceptions regarding monthly service fees for minors?

Yes, for EASE by Bank of Hawaii accounts, the monthly service fee is waived for accountholders while under 18 years of age. This applies only for sole account ownerships.

How do I know if my monthly service fee change is effective on October 1, 2024 or January 1, 2025?

If you had a Free Checking account that was converted into a Convenience Checking account in May 2015, your monthly service fee change will go into effect on January 1, 2025 instead of October 1, 2024.

I would like to know more about the monthly service fee changes.

For more information, see the Changes to the Bank of Hawaii Consumer Checking and Savings Account Fee Schedule.

What if I want to change my account based on the monthly service fee changes?

We’re happy to help you find a checking account that will meet your needs. Book an appointment with a banker to learn more about your options.

You're about to exit BOH.com

Links to other sites are provided as a service to you by Bank of Hawaii. These other sites are neither owned nor maintained by Bank of Hawaii. Bank of Hawaii shall not be responsible for the content and/or accuracy of any information contained in these other sites or for the personal or credit card information you provide to these sites.