EASE by Bank of Hawaii: Outline of Basic Terms & Conditions

Learn how and when fees are assessed for EASE by Bank of Hawaii.

If you’re an existing online and mobile banking customer, we’ll send you an email to let you know when you’ll be able to download and use the new app. New online and mobile banking customers can download the app now.

A simple way to grow your savings

minimum opening deposit of $25

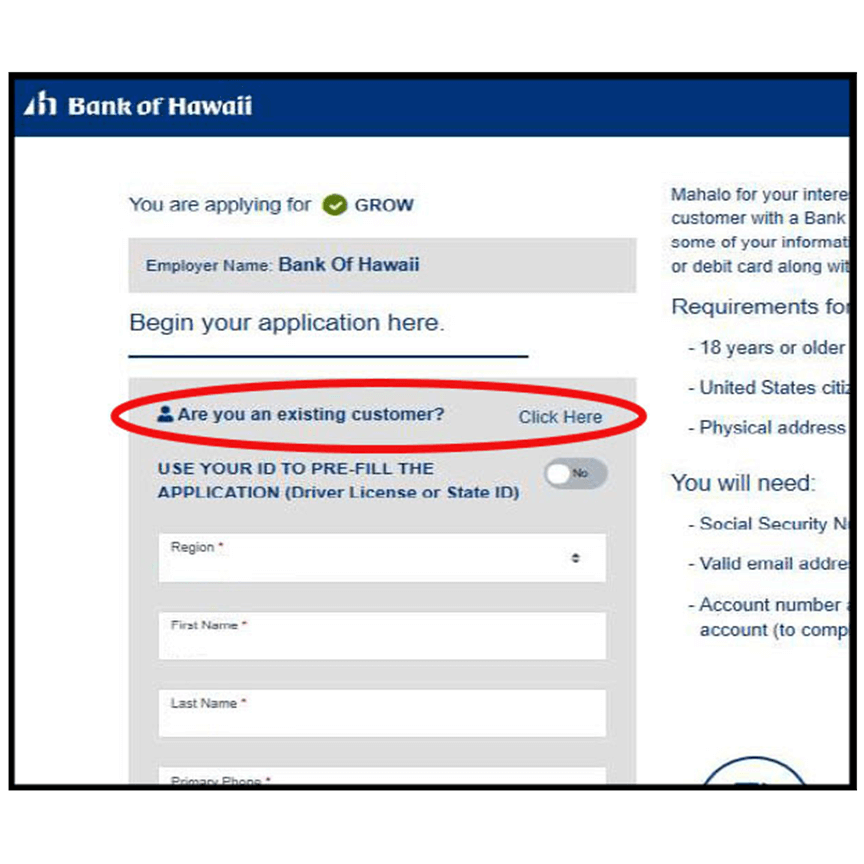

If you have an account, make sure you select "Click Here" next to the question "Are you an existing Customer?"

And have one of these ready:

At Bank of Hawaii, we strive to offer you innovative financial solutions that help you grow your financial wellness. Our new GROW account is just one component of our new GROW Program.

Step 1: Click "Open now" to sign up for a GROW account

Step 2: Start saving

Step 3: Get rewarded!

When you save $500, you'll get a one-time reward of $50 into your GROW account. Save $1,000, and you'll receive an additional one-time reward of $100.

Before you begin: If you have an account, make sure you “Click Here” next to the question “Are you an existing Customer?” and use either Debit Card and PIN or e-Bankoh login credentials when opening the account.

Learn how and when fees are assessed for EASE by Bank of Hawaii.

Yes: this reward is exclusive to the EASE by Bank of Hawaii GROW Account and will not be deposited into any other account or paid in cash.

For employees who already have an EASE account and who would like to participate in the GROW program, please set up a new EASE by Bank of Hawaii GROW Account (it comes with a white card), and is designated specifically for the emergency rainy day fund reward.

The Ease by Bank of Hawaii Grow Account can only be set up through the BOH portal in the employee’s name as a sole account.

Rewards will be deposited to GROW accounts in August and February. Please note that you must be a BOH employee at the time the deposit is made.

Yes, you will receive a one-time reward of $50 when you save $500, and an additional one-time reward of $100 when you save $1,000. The total possible amount of the reward is $150. If you save $1,000 before the $50 reward is deposited for saving $500, you will receive the entire one-time reward of $150.

At this time, there is no additional reward for savings over the $1,000. You will receive a one-time reward of $50 when you save $500, and an additional one-time reward of $100 when you save $1,000. The total possible amount of the reward is $150. There are no additional rewards for saving more.

The reward amounts deposited to your GROW Account are considered compensation and you are responsible for the taxes. However, Bank of Hawaii will ‘gross up’ the reward and pay you additional monies to cover the taxes.

Yes: this reward is exclusive to the EASE by Bank of Hawaii GROW Account and will not be deposited into any other account or paid in cash.

For employees who already have an EASE account and who would like to participate in the GROW program, please set up a new EASE by Bank of Hawaii GROW Account (it comes with a white card), and is designated specifically for the emergency rainy day fund reward.

The Ease by Bank of Hawaii Grow Account can only be set up through the BOH portal in the employee’s name as a sole account.

Rewards will be deposited to GROW accounts in August and February. Please note that you must be a BOH employee at the time the deposit is made.

Yes, you will receive a one-time reward of $50 when you save $500, and an additional one-time reward of $100 when you save $1,000. The total possible amount of the reward is $150. If you save $1,000 before the $50 reward is deposited for saving $500, you will receive the entire one-time reward of $150.

At this time, there is no additional reward for savings over the $1,000. You will receive a one-time reward of $50 when you save $500, and an additional one-time reward of $100 when you save $1,000. The total possible amount of the reward is $150. There are no additional rewards for saving more.

The reward amounts deposited to your GROW Account are considered compensation and you are responsible for the taxes. However, Bank of Hawaii will ‘gross up’ the reward and pay you additional monies to cover the taxes.

Learn more about the different types of balances for your account.

![]()

Take charge of your financial health: With just a few simple questions, our Financial Health Tracker creates a personalized Financial Health Score - broken down into four key areas: Spending, Saving, Borrowing, and Planning. Based on your score, you receive useful tips to help you make progress where you need it most.

We’re proud to partner with national financial educator EVERFI®6 to present a comprehensive financial education program that will help you take positive steps toward reaching your goals. Start building your knowledge and confidence today.

The interactive lessons include topics such as: Money Basics, Buying a Home, Loans & Payments, Paying for College, Retirement Planning and Preventing Elder Fraud.

Check out our easy-to-use financial calculators. Whether you’re building a monthly budget or creating an emergency savings account, these tools will help you plan.

A majority (54%) of Hawaii residents spent equal to or more than their income. This compares unfavorably to the national figure of 46% and reflects the relatively high cost of living in Hawaii comprised primarily of housing (18%-23%), child care (13%-20%), food (16%-17%), and transportation (9%) expenses. Let us suggest ways for you to spend less than your income and pay all of your bills on-time.*

Particularly in Hawaii where housing prices are among the highest in the nation and wages are constrained, many residents are forced to take on large debt loads. Having a prime credit score, e.g., 700 or higher, is necessary for access to the lowest cost financial products. Although Hawaii residents do better than their national peers in terms of having a prime credit score, there is still opportunity for people to learn how to improve and maintain a prime credit score.*

As a general rule-of-thumb, saving 3 months or even 6 months of living expenses is important to cover a financial shock. A financial shock is an unforeseen income drop or expense item. A significant amount of Hawaii residents (35%) do not have enough savings to cover 3 months of living expenses. Let us suggest ways for you to save for an emergency and save for your retirement.*

Hawaii residents are less confident than their national peers that they have insurance policies that will provide sufficient support in case of an emergency. Approximately half (49%) of Hawaii residents reported that they were not confident in their insurance policies compared with 42% nationally. Although Hawaii residents (65%) plan their finances ahead better than their national peers (59%), they are likely to have less financial margin to face financial shocks.*

6 EVERFI is a registered trademark of EverFi, Inc.

*This data is part of the Hawaii Financial Health Pulse 2019 Survey, developed by the Financial Health Network. The content of this web page is solely the responsibility of the authors and does not necessarily represent the official views of the Financial Health Network.

Provided for informational purposes only and is not intended to be financial advice by Bank of Hawaii. Bank of Hawaii will not be responsible for any damages resulting from reliance upon the information provided. Please consult a financial professional for information applicable to your specific situation.

Links to other sites are provided as a service to you by Bank of Hawaii. These other sites are neither owned nor maintained by Bank of Hawaii. Bank of Hawaii shall not be responsible for the content and/or accuracy of any information contained in these other sites or for the personal or credit card information you provide to these sites.