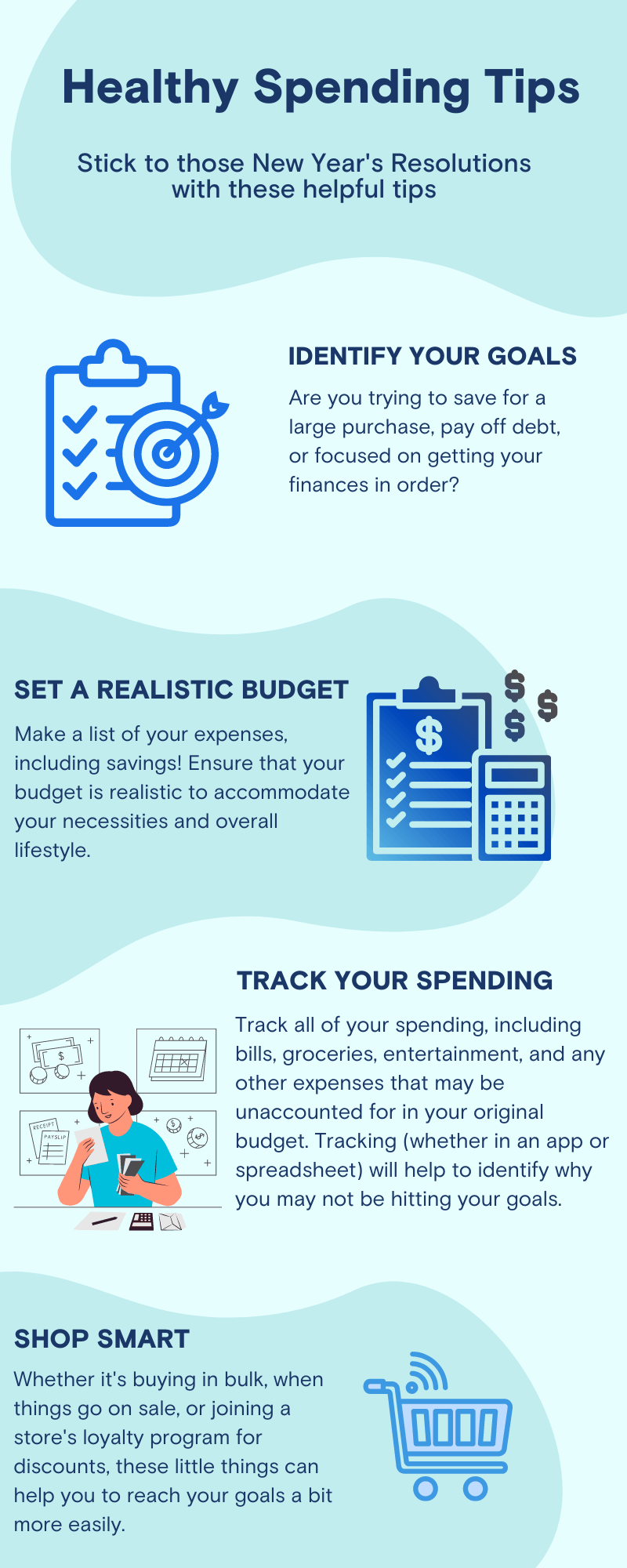

Stick to your New Year’s Resolutions with

these Healthy Spending Tips

Reading time: 3 minutes

January 19th, 2023

Let 2023 be the year you stick to those New Year’s resolutions and hit your goals! While life can throw unforeseen challenges, these tips can help to get you on the right track to where you want to be. We’ve put together some healthy spending tips to support you make 2023 the year you’re on your financial wellness journey.

Identify Your Goals

Start by taking the time to sit down and list your goals, short and long-term. From there, identify which goals you want to hit this year. Is this the year you save up for a large purchase, pay off that debt, or focus on getting your finances in order? Before beginning the process of setting a budget, it is important to consider your financial goals and determine what you are trying to accomplish with your budget. If you’re focused on getting out of debt, here are some of our debt management tips.

Set a Realistic Budget

After identifying your goals, look at your expenses to help you set a realistic budget. Once you have identified your goals and listed your expenses, you can begin setting a budget. Start by assigning a dollar amount to each expense and ensure that your total expenses do not exceed your income. It’s imperative to add in a regular savings budget to your overall budget. Even if it’s a small amount every month, every dollar will add up to help you save for a rainy day or for that big purchase you’re looking to make this year. Read these smart spending tips.

Track Your Spending

After you’ve created your budget, continue tracking all spending – whether it’s through an app on your smart phone or on a spreadsheet. Continuing to track all of your expenses (and last minute purchases) will help you to nail down where you can tighten your spending and listing those last minute items that you may have forgotten to list in your budget. Read these tips if you need help on revising and adjusting your budget after you’ve done tracking.

Shop Smart

To set yourself up for optimal success of hitting those financial wellness goals, consider how and where you shop. Buying in bulk at warehouse type stores can help you to cut down on costs of items that you use regularly, including toilet paper, paper towel, and cabinet types of foods (that don’t perish as quickly). Enrolling for store loyalty programs can provide exclusive offerings for discounts or sale items. Speaking of sale items, waiting for items to go on sale (or better yet, clearance) can help to save some money as well.

If you’re interested in talking with an expert, make an appointment with us today – in person or from the comfort of your own home. We’re here to help you live your happy, whether it’s managing today’s needs or building a better tomorrow.

You're about to exit BOH.com

Links to other sites are provided as a service to you by Bank of Hawaii. These other sites are neither owned nor maintained by Bank of Hawaii. Bank of Hawaii shall not be responsible for the content and/or accuracy of any information contained in these other sites or for the personal or credit card information you provide to these sites.