Joint vs. Separate Bank Accounts for Couples: How to Choose

Reading time: 5 Minutes

August 11th, 2023

When you're in a romantic relationship, talking about money is essential. As a team, you'll need to decide: do we want to manage our money together or separately? There's no right or wrong answer. But it's important to find the right fit for your relationship.

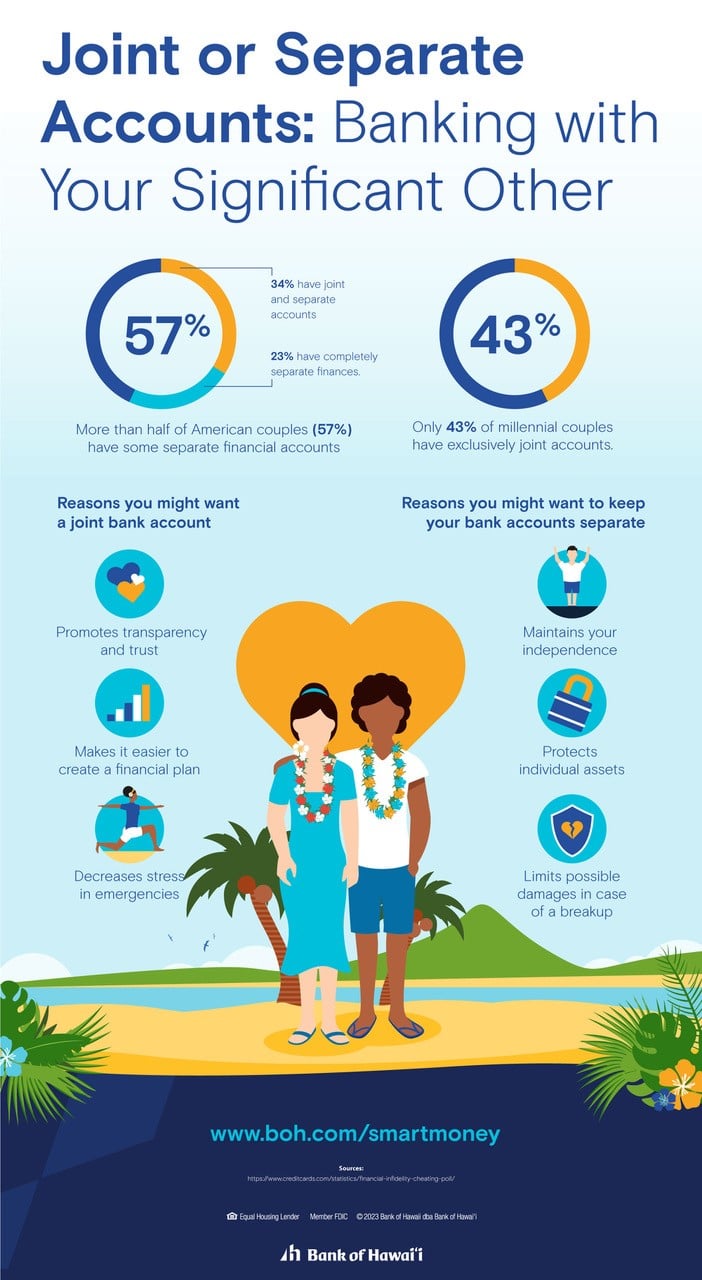

Traditionally, most married couples combined their finances in a joint bank account. But according to a recent survey, only 43% of couples use exclusively joint accounts today. Instead, there's a whole range of options for managing joint finances and many couples have a unique system they create themselves.

Here's a complete breakdown of how joint bank accounts work. Plus, why you should consider separate, joint, or a mix of both.

How Joint Accounts Work

Joint bank accounts are a type of bank account that allows more than one person to access funds and manage the account. Checking and savings accounts can both be joint accounts.

Account owners can include spouses, partners, or significant others. Everyone named on the account has equal access to the money, regardless of who opens the joint account or deposits funds.

The Federal Deposit Insurance Corporation (FDIC) and the National Credit Union Administration (NCUA) provide $250,000 of federally backed insurance coverage per depositor, per FDIC insured bank or NCUA insured credit union, per ownership category, in case of bank failure. So a joint account with two owners receives up to $500,000 of deposit insurance instead of $250,000 for an individual account. *

Reasons You Might Want a Joint Bank Account

1. Promotes transparency and trust

Joint accounts can encourage clear lines of communication between significant others. Transactions are visible online and in the bank app for all account owners, so sharing an account can create openness and accountability in a relationship.

With 32% of adults reporting that they've kept a financial secret from their partner, joint accounts can make it easier for some couples to stay on the same page. That doesn't mean couples with separate accounts don't have open communication. But joint accounts can encourage a sense of togetherness and help couples perceive finances as shared.

2. Makes it easier to create a financial plan

For some couples, keeping track of who pays for what is annoying. Joint accounts can alleviate that stress. Combined accounts can make it simple to pay shared bills. Plus, you're more likely to evenly split the responsibilities of credit cards, bill payments and account transfers if everything is in one place.

Some couples find it easier to create a budget, plan for the future and stay motivated with a joint account. It's a joint venture, so you and your other half might find that you review your finances more often and set goals as a team.

3. Decreases stress in emergencies

You or your partner can access the money in a joint account anytime. Shared access is a game-changer in stressful situations. For example, if your car breaks down, you can immediately write a check for repairs using joint funds. And if an actual emergency like hospitalization occurs, one partner has access to all the finances and can keep the household running.

It's hard even to consider, but if one partner becomes incapacitated or passes away, the other partner can avoid legal complications and maintain access to the account.

Reasons You Might Want to Keep Your Bank Accounts Separate

1. Maintains your independence

You and your partner can maintain some degree of freedom over your finances with separate bank accounts. Even though shared accounts can simplify financial tasks and increase efficiency, it's not worth it if the cost is your sense of autonomy and independence.

All transactions are visible with joint accounts, which might make it feel like your other half is watching your every move. Even in the best relationship, this might feel like a loss of privacy. Depending on your personal history and experiences, you may place extra value on financial autonomy.

2. Protects individual assets

If you and your partner are in significantly different financial circumstances, it might be wise to maintain separate accounts. For example, suppose you have six figures of debt. You might want to try to protect your partner's repayment responsibility. Or maybe you and your significant other both worked hard to become high earners and want to enjoy your paychecks without feeling obligated to one another.

Plus, joint account balances can inflate assets for eligibility purposes. If your significant other is in college, it could affect their eligibility for financial aid. Or if you're in retirement, it could reduce your eligibility for Medicaid long-term care.

3. Limits possible damages in case of a breakup

It's never fun to think about relationships ending, but it does happen. Unfortunately, joint accounts can sometimes get caught in the middle when two people break up. If a couple splits, both parties continue to share a joint account until it's closed. So if one person empties the account, legal action might be necessary.

It can get messy, so some couples prefer to keep their accounts separate.

Reasons to Consider a Hybrid System

A hybrid system, with some joint and separate accounts, is another option for couples. Some couples consider it the best of both worlds — you can merge some of your money into a shared account and keep the rest in individual accounts.

Here's how the setup might work — couples use the joint account to pay everyday bills like their mortgage, groceries and utilities. In the separate accounts, each person has a pot of money to spend however that person sees fit. Want to splurge on expensive new hiking gear without running it by your other half? No problem. Some couples consider this an "allowance" and allocate a certain amount to separate accounts each month.

Other couples flip that system and prefer to keep most money separate. Instead, the couple has one joint account for shared goals or expenses, and everything else is separate. This configuration is popular for couples saving for a wedding or big trip.

How to decide which account is right for you

Deciding between joint accounts, separate accounts or a hybrid system for you and your significant other is challenging. But the good news is that there's no correct answer.

If you need help deciding which approach to choose, discuss the following questions with your other half.

- How will we pay for regular expenses like rent and groceries?

- How will we prepare for emergencies?

- Do we want to simplify our joint costs?

- How will we handle debt payoff?

- How will we save for big life goals (i.e., home buying, children's college expenses and retirement?)

Talk through the questions and focus on open communication. If you're both honest about what you want, you'll find the perfect fit for your relationship.

Ready to learn more about your options for a joint account at Bank of Hawaii? Here's everything you need to know.

*See the FDIC website for details on the per-depositor limitation.

You're about to exit BOH.com

Links to other sites are provided as a service to you by Bank of Hawaii. These other sites are neither owned nor maintained by Bank of Hawaii. Bank of Hawaii shall not be responsible for the content and/or accuracy of any information contained in these other sites or for the personal or credit card information you provide to these sites.