Everything You Need to Know about Your Paystub

Reading time: 5 Minutes

September 4th, 2020

Everyone loves a paycheck. Getting paid for all your hard work always has a special feeling.

But, thanks to the rise of direct deposit in recent decades, many people never see their physical paychecks from month to month. And that means that these people may also be missing out on another important document: their paystubs.

Though it's easy (and a great idea!) to have your wages automatically deposited to your bank account, it's also a good idea to periodically review your paystub, which is the written pay statement that summarizes in detail your income, taxes and other important information for each pay period.

Paystubs, also known as wage statements or pay slips, contain critical information that can help you understand your finances and manage your money, including planning a budget or setting up a 401(k) retirement account. Regularly reviewing your paycheck can also help protect against any errors in your income and prepare you for tax time. If you are getting paid via direct deposit, your employer should be able to generate your paystubs on request, or may have a secure website where you can check them.

If you aren't too familiar with all the numbers and info listed on your paystub, here are a few key things to look for:

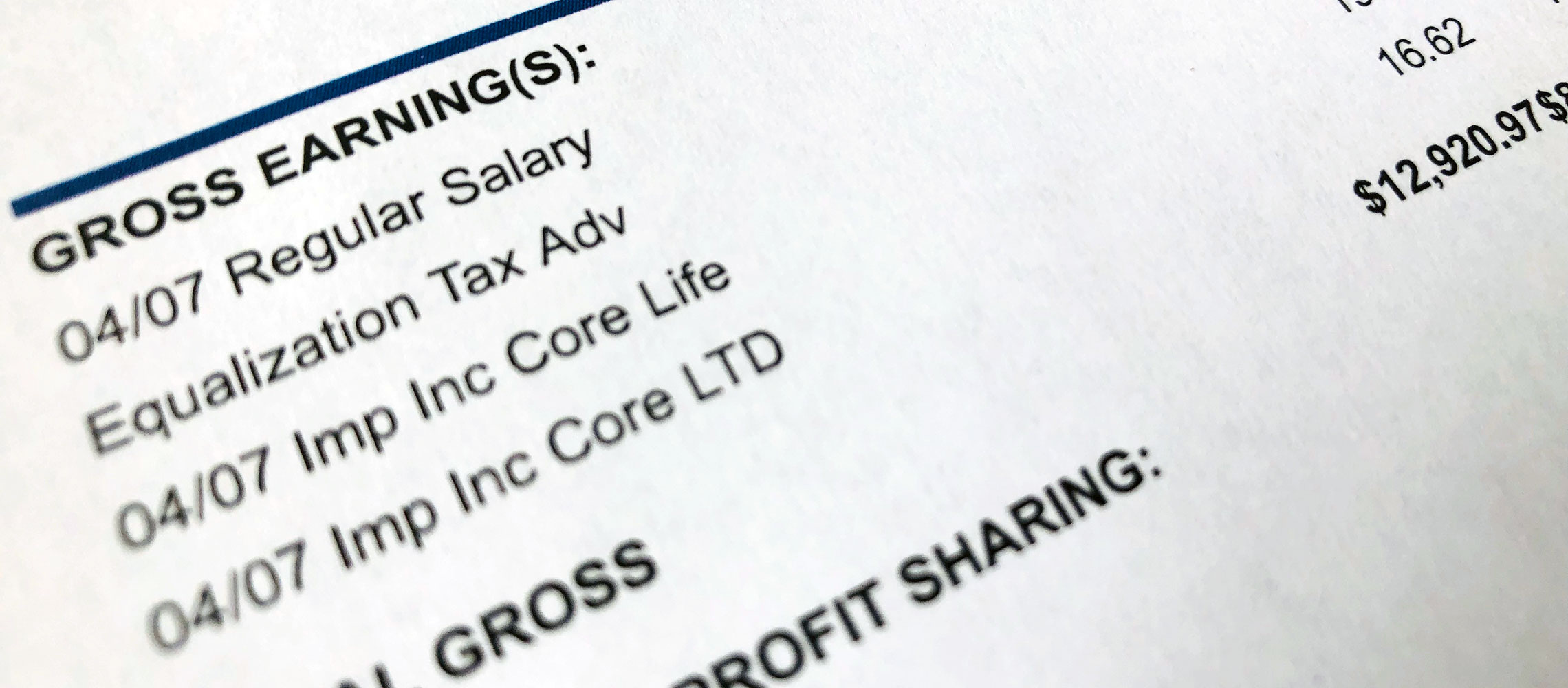

Your Pay

The income you receive is broken into two categories called gross pay and net pay. Gross pay is how much total money you earned from your employer that pay period before any taxes or deductions are taken out. Net pay is the actual amount of money you receive after these deductions.

Understanding your gross versus net pay lets you know how much of your salary you're actually able to take home. This info can also help in planning a budget, determining how much to set aside towards debt or deciding what can be saved for future goals, such as towards retirement, buying a home, your children's college or travel.

Taxes

There are a number of different types of payroll taxes taken out of a given paycheck. Your pay stub will likely indicate how much taxes were taken out in that specific check, as well as the total amount of taxes withdrawn over the year to date.

One example is federal income tax, which is the percentage the federal government receives from its citizens. The amount you pay is determined by how much money you make and how many dependents you claim on taxes. The current U.S. personal income tax rate begins at 10 percent and increases on a graduated scale to a top rate of 37 percent. At the end of the year, if the money deducted is less than actual federal tax liability that you owe as a tax-paying citizen, you'll receive a refund.

Depending on your personal financial situation, you may want to adjust your withholding allowance, to take either more or less federal tax out of each paycheck. This will allow you to avoid a situation where you owe a large amount of taxes at the end of the year, or even the reverse, where too much was taken out throughout the year.

Another type of payroll tax is state income taxes, which are taken out to support the State of Hawaii, for services including economic development, transportation and infrastructure, environmental projects, maintaining our public parks and recreation areas as well as support for low-income families, persons with disabilities and public employees.

Another tax that is taken out is the Federal Insurance Contributions Act, or FICA tax, a mandatory contribution toward Social Security that every working person must make. This program provides monthly retirement benefits to seniors.

You'll also need to contribute to Medicare, a national health insurance program for citizens over the age of 65.

Additionally, if you have outstanding debt, such as child support payments or a tax bill, your employer might withhold a certain additional amount of your paycheck; this is called wage garnishment.

Deductions and Contributions

Other paycheck deductions include payments for various medical, dental or life insurance, if you've signed up for insurance plans through your employer that aren't fully covered by that employer.

Many employers offer retirement savings plans, such as a 401(k), so you can set aside for the future that in most cases you won't have to pay taxes on until you begin withdrawing. Some employers will even help you save by adding to your retirement fund with a 401(k) match program. It's a good idea to inquire if one of these is available at your workplace, as it can significantly boost your retirement nest egg.

You may also want to consider having money deducted for a flexible spending accounts. This program can set aside pre-tax dollars for medical expenses, such as insurance deductibles, prescription drugs or health insurance copayments—potentially saving you money.

Check Your Paystubs to be Safe

Whether you're examining a physical paystub received from an envelope at work or your company requires you to log in to a secure payroll system from a computer, it's important to verify the information on your paystubs, because clerical errors can and do happen.

Take a few minutes during each pay period to review your paycheck to confirm it matches what's on your W-2 form, which details your taxes paid for the year, and which is used to complete your annual income tax returns.

It's your responsibility to report anything that looks out of place to your company's human resources department. Catch any mistakes before errors get repeated across several pay checks—if your employer isn't taking out the correct amount of taxes before your net pay, you could owe money at the end of the year.

It's also important to have access to your paychecks to help meet certain financial goals. For example, banks and lending institutions will often ask you to provide paystubs if you're applying to rent an apartment, to secure a mortgage or loan, to verify your current employment or as part of the hiring process.

It's definitely fun to celebrate on pay day—just make sure you check that you're getting paid right.

You're about to exit BOH.com

Links to other sites are provided as a service to you by Bank of Hawaii. These other sites are neither owned nor maintained by Bank of Hawaii. Bank of Hawaii shall not be responsible for the content and/or accuracy of any information contained in these other sites or for the personal or credit card information you provide to these sites.