Our People. Our Stories.

Get to know Chris Otto, a leader in Bankoh Investment Services, Inc., who helps families plan for whatever the future may bring.

Earn 4.50% APY2 with our CD* Special

* Bank of Hawaii Time Deposit Account

2 Certain requirements apply.

Where dreams come home

Start your transformation today with our mortgage, refinance, and HELOC options.

SmartMoney Learning Center

Designed to support your journey toward life-long financial well-being.

Bank by Appointment

Choose from in-person or phone appointments at a time and location that’s convenient for you.

Earn 60,000 Bonus HawaiianMiles

after spending $2,000 on purchases in the first 90 days* with a new Hawaiian Airlines® Bank of Hawaii World Elite Mastercard®.

*See Terms and Conditions for details.

Need help opening the right deposit account?

We can help. Just answer a few questions and we’ll help you find a deposit account that meets your needs.

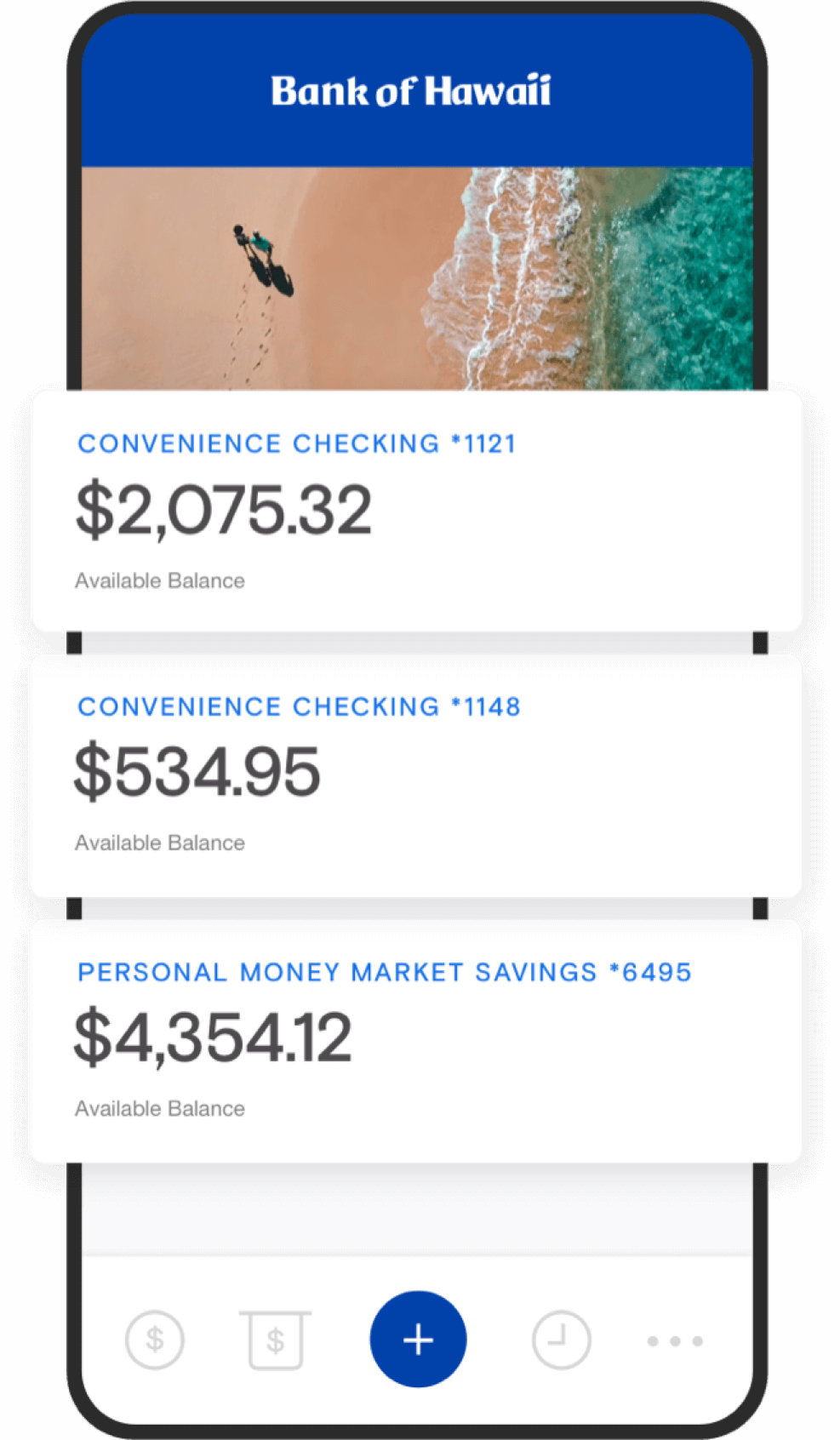

Manage your money on the go.

Check your balance

Pay bills & deposit checks

Send money to a friend—with Zelle®

iPhone® is a registered trademark of Apple® Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. AndroidTM is a trademark of Google Inc. Google Play and the Google Play logo are trademarks of Google Inc. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Essential Elements of a Comprehensive Financial Plan

A financial plan serves as a roadmap for achieving your financial goals and securing a stable future—whatever life brings.

Stories that inspire

We’re touched by this land and the people and businesses that live and work here. See how they inspire us.

Visit a branch near you

Come and talk to us about your goals at one of our many conveniently located branch locations, in Hawaii, Guam, Saipan, and Palau. We’re here to serve you.

Trusted Lender

#1 in total dollars and numbers of loans made in the State of Hawaii.+

+#1 Residential Lender ranking is for total number of residential loans and total dollars made by a lender in the State of Hawaii in 2022. Information compiled by Title Guaranty derived from Hawaii Bureau of Conveyances tax data recorded information for 2022. Information is deemed reliable but not guaranteed.

You're about to exit BOH.com

Links to other sites are provided as a service to you by Bank of Hawaii. These other sites are neither owned nor maintained by Bank of Hawaii. Bank of Hawaii shall not be responsible for the content and/or accuracy of any information contained in these other sites or for the personal or credit card information you provide to these sites.